Question: Exercise 7-61 Analyze Fixed Assets Tabor Industries is a technology company that operates in a highly competitive environment. In 2016, management had significantly curtailed

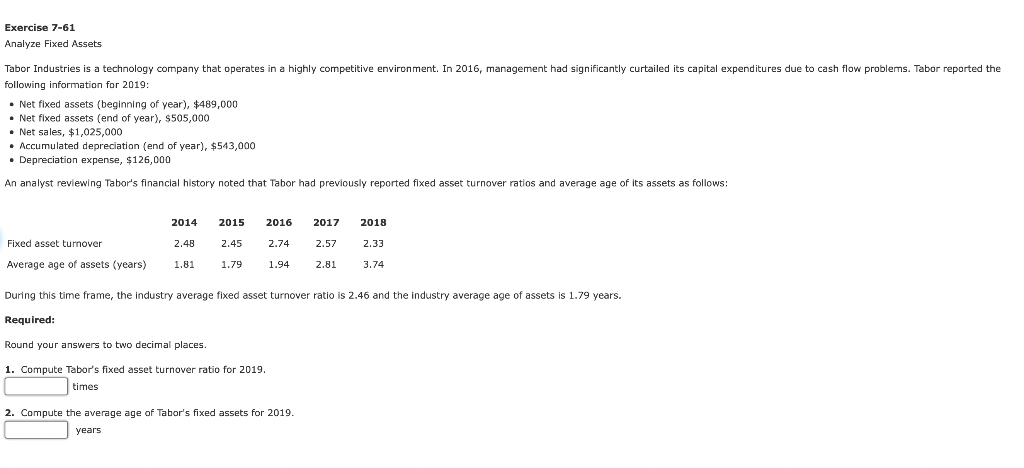

Exercise 7-61 Analyze Fixed Assets Tabor Industries is a technology company that operates in a highly competitive environment. In 2016, management had significantly curtailed its capital expenditures due to cash flow problems. Tabor reported the following information for 2019: Net fixed assets (beginning of year), $489,000 Net fixed assets (end of year), $505,000 Net sales, $1,025,000 Accumulated depreciation (end of year), $543,000 Depreciation expense, $126,000 An analyst reviewing Tabor's financial history noted that Tabor had previously reported fixed asset turnover ratios and average age of its assets as follows: 2014 2015 2016 2017 2018 Fixed asset turnover 2.48 2.45 2.74 2.57 2.33 Average age of assets (years) 1.81 1.79 1.94 2.81 3.74 During this time frame, the industry average fixed asset turnover ratio is 2.46 and the industry average age of assets is 1.79 years. Required: Round your answers to two decimal places. 1. Compute Tabor's fixed asset turnover ratio for 2019. times 2. Compute the average age of Tabor's fixed assets for 2019. years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts