Question: EXERCISE 7A-3 Second-Stage Allocations and Margin Calculations Using the Action Analysis Approach [L04, L06] Refer to the data for Foam Products, Inc., in Exercise 7-12

![Approach [L04, L06] Refer to the data for Foam Products, Inc., in](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e88349e26b5_99366e883494ddf7.jpg)

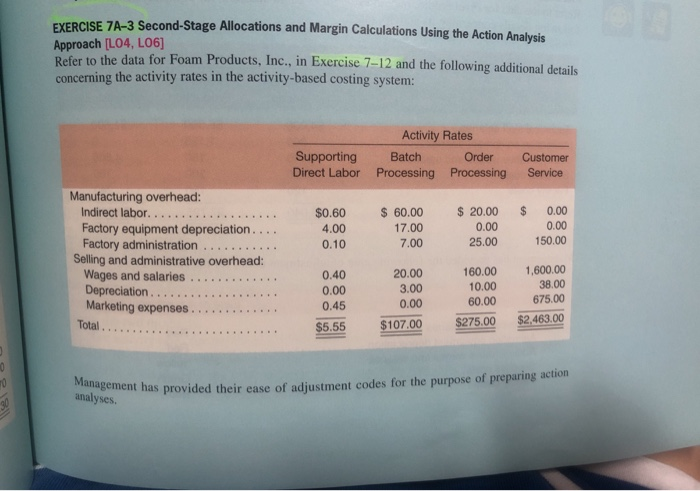

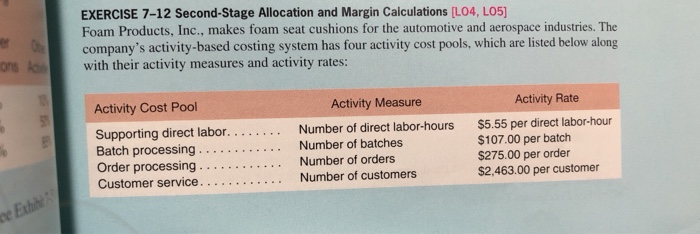

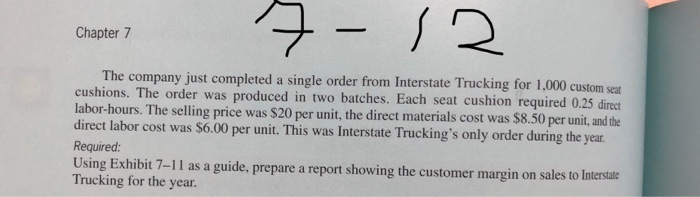

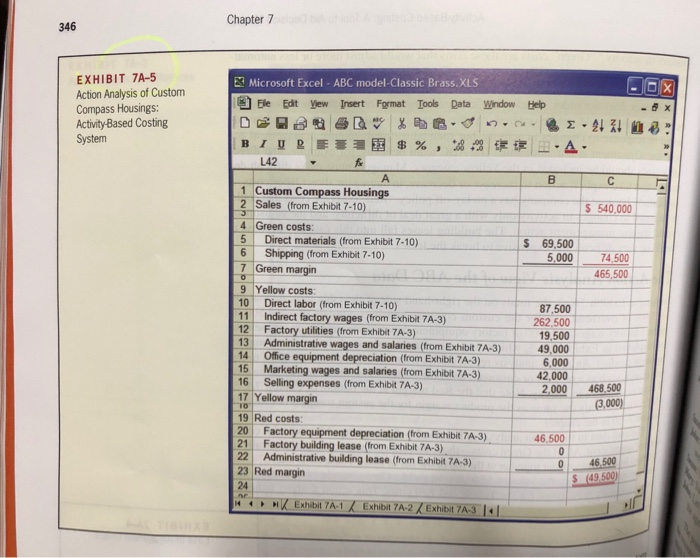

EXERCISE 7A-3 Second-Stage Allocations and Margin Calculations Using the Action Analysis Approach [L04, L06] Refer to the data for Foam Products, Inc., in Exercise 7-12 and the following additional details concerning the activity rates in the activity-based costing system: Activity Rates Supporting Direct Labor Batch Order Customer Processing Processing Service Manufacturing overhead: Indirect labor... Factory equipment depreciation.... Factory administration Selling and administrative overhead: Wages and salaries Depreciation.. Marketing expenses Total... $ 20.00 $ 0.00 $ 60.00 $0.60 0.00 0.00 17.00 4.00 150.00 25.00 7.00 0.10 1,600.00 160.00 20.00 0.40 38.00 10.00 3.00 0.00 675.00 60.00 0.00 0.45 $2,463.00 $275.00 $107.00 $5.55 Management has provided their ease of adjustment codes for the purpose of preparing action analyses 0 Chapter 7 Ease of Adjustment Codes Green Direct materials Direct labor Yellow Manufacturing overhead: Indirect labor Yellow Red Factory equipment depreciation Factory administration Selling and administrative overhead: Wages and salaries Depreciation.. Marketing expenses. Red Red Red Yellow Required: Using Exhibit 7A-5 as a those prepared for products. guide, prepare an action analysis report for Interstate Trucking similar to EXERCISE 7-12 Second-Stage Allocation and Margin Caiculations [L04, LO5] Foam Products, Inc., makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Oe ons Ad Activity Cost Pool Activity Measure Activity Rate Supporting direct labor. . Batch processing Order processing Customer service. Number of direct labor-hours Number of batches Number of orders $5.55 per direct labor-hour $107.00 per batch $275.00 per order $2,463.00 per customer Number of customers e Exhine Tl-t /2 Chapter 7 The company just completed a single order from Interstate Trucking for 1,000 custom seat cushions. The order was labor-hours. The selling price was $20 per unit, the direct materials cost was $8.50 per unit, and the direct labor cost was produced in two batches. Each seat cushion required 0.25 direct S $6.00 per unit. This was Interstate Trucking's only order during the year. Required: Using Exhibit 7-11 Trucking for the year. a guide, preparea report showing the customer margin as on sales to Interstate Chapter 7 346 EXHIBIT 7A-5 Action Analysis of Custom Compass Housings: Activity-Based Costing System Microsoft Excel - ABC model-Classic Brass. XLS Fle Edit View Insert Fgrmat Tools Data Window Help - X % BIUR E 8 $% . AM L42 A 1 Custom Compass Housings 2 Sales (from Exhibit 7-10) C S 540,000 4 Green costs: 5 Direct materials (from Exhibit 7-10) Shipping (from Exhibit 7-10) 7 Green margin $ 69,500 5,000 74,500 465,500 99A 9 Yellow costs: Direct labor (from Exhibit 7-10) Indirect factory wages (from Exhibit 7A-3) Factory utilities (from Exhibit 7A-3) Administrative wages and salaries (from Exhibit 7A-3) Office equipment depreciation (from Exhibit 7A-3) 15 10 87,500 262,500 19.500 49.000 11 12 13 14 6,000 42,000 Marketing wages and salaries (from Exhibit 7A-3) 16 Selling expenses (from Exhibit 7A-3) 17 Yellow margin 468.500 2,000 (3,000) TO 19 Red costs: Factory equipment depreciation (from Exhibit 7A-3) 21 20 46.500 0 Factory building lease (from Exhibit 7A-3) Administrative building lease (from Exhibit 7A-3) 23 Red margin 22 46.500 $ (49.500) 24 4 HExhibit 7A-1 Exhibit 7A-2Exhibit 7A-3 o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts