Question: Exercise 8 - 1 9 ( Static ) Tax Custodial Fund [ LO 8 - 2 ] Skip to question [ The following information applies

Exercise Static Tax Custodial Fund LO

Skip to question

The following information applies to the questions displayed below.

The county collector of Sun County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax custodial fund, the custodial fund deducts percent from the collections for the town, the school district, and the other towns. The total amount deducted is added to the collections for the county and remitted to the Sun County General Fund.

The following events occurred during the year:

Currentyear tax levies to be collected by the custodial fund were

County General Fund$Town of BayshoreSun County Consolidated School DistrictTotal$

During the year, $ of the current year's taxes was collected.

The percent administrative collection fee was recorded. A schedule of amounts collected for each participant, showing the amount withheld for the county General Fund and net amounts due to the participants, is recommended for determining the amount to be recorded for this transaction.

All cash in the tax custodial fund was distributed.

Necessary closing entries were made at fiscal yearend.

Exercise Static Part b

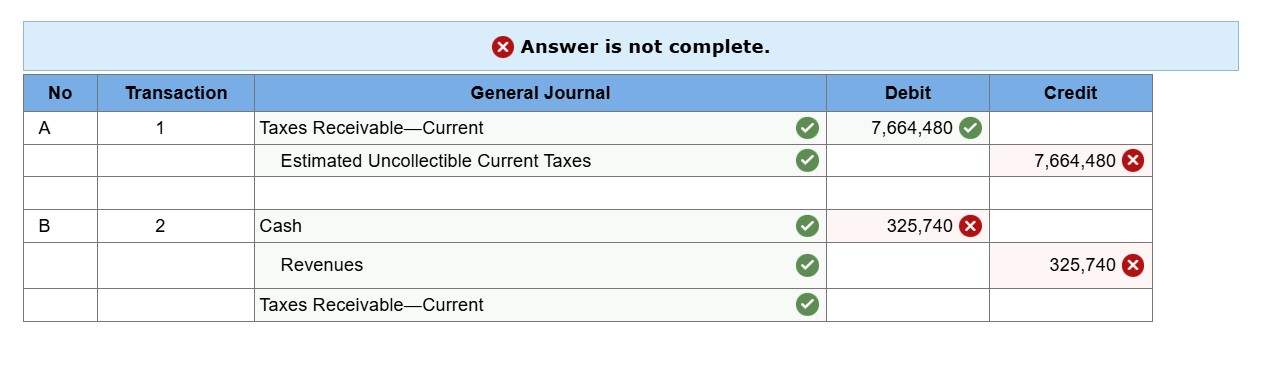

Prepare journal entries for each of the foregoing transactions that affected the Sun County General Fund. Begin with the tax levy entry, assuming percent of the gross levy will be uncollectible. If no entry is required for a transactionevent select No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. Answer is not complete.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock