Question: Exercise 8: Complete the following problem. A $20,000, 2 year, 10% (Stated rate) bond is sold when the Effective (Market) rate is 8%. The

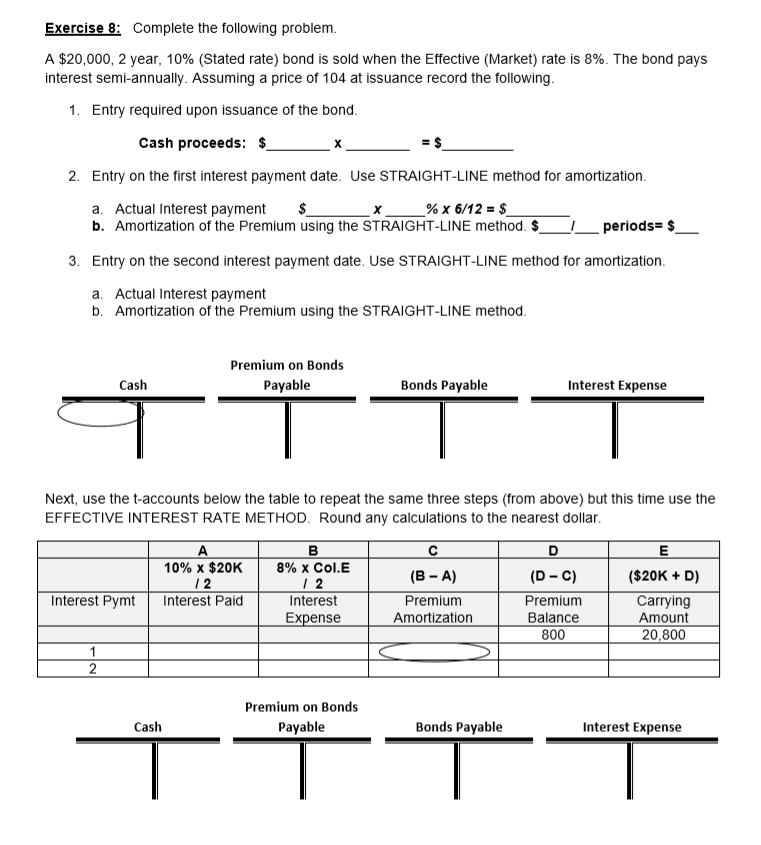

Exercise 8: Complete the following problem. A $20,000, 2 year, 10% (Stated rate) bond is sold when the Effective (Market) rate is 8%. The bond pays interest semi-annually. Assuming a price of 104 at issuance record the following. 1. Entry required upon issuance of the bond. Cash proceeds: $ = $ 2. Entry on the first interest payment date. Use STRAIGHT-LINE method for amortization. a. Actual Interest payment $ % x 6/12 = $_ b. Amortization of the Premium using the STRAIGHT-LINE method. $_ periods= $ 3. Entry on the second interest payment date. Use STRAIGHT-LINE method for amortization. a. Actual Interest payment b. Amortization of the Premium using the STRAIGHT-LINE method. Cash Premium on Bonds Bonds Payable TTT Interest Pymt 1 2 X A 10% X $20K 12 Interest Paid Payable Next, use the t-accounts below the table to repeat the same three steps (from above) but this time use the EFFECTIVE INTEREST RATE METHOD. Round any calculations to the nearest dollar. Cash X B 8% x Col.E 12 Interest Expense Premium on Bonds Payable (B-A) Premium Amortization Interest Expense Bonds Payable D (D-C) Premium Balance 800 E ($20K + D) Carrying Amount 20,800 Interest Expense

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

To solve this problem we need to complete the following steps for both the StraightLine and Effective Interest Rate Methods StraightLine Method 1 Entr... View full answer

Get step-by-step solutions from verified subject matter experts