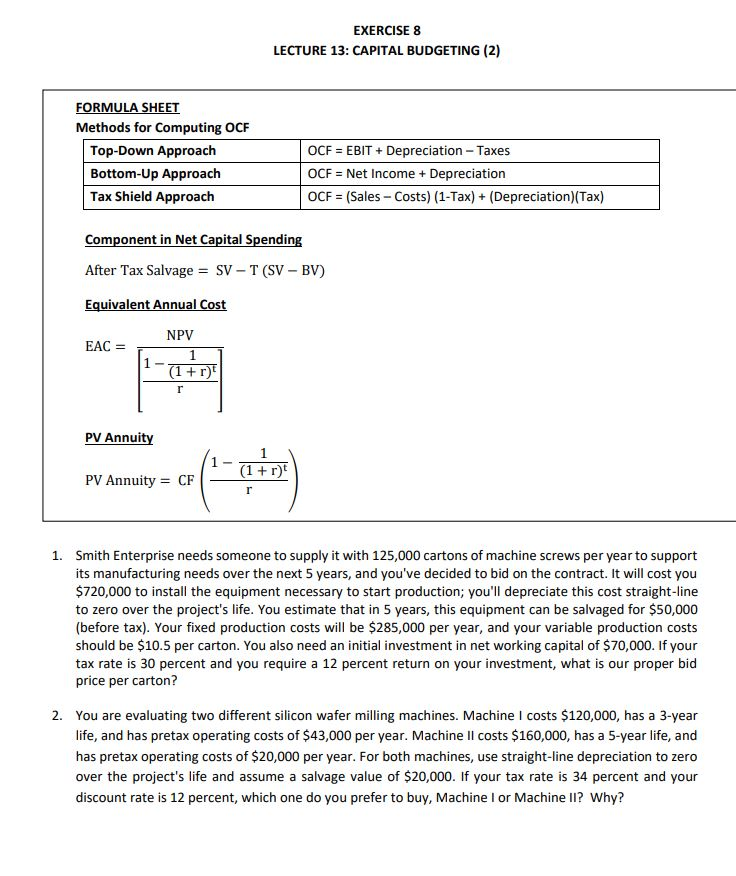

Question: EXERCISE 8 LECTURE 13: CAPITAL BUDGETING (2) FORMULA SHEET Methods for Computing OCF Top-Down Approach Bottom-Up Approach Tax Shield Approach OCF = EBIT + Depreciation

EXERCISE 8 LECTURE 13: CAPITAL BUDGETING (2) FORMULA SHEET Methods for Computing OCF Top-Down Approach Bottom-Up Approach Tax Shield Approach OCF = EBIT + Depreciation - Taxes OCF = Net Income + Depreciation OCF = (Sales - Costs) (1-Tax) + (Depreciation)(Tax) Component in Net Capital Spending After Tax Salvage = SV - T (SV - BV) Equivalent Annual Cost NPV EAC = 1 (1 + r) r PV Annuity 1 (1 + r) PV Annuity = CF r 1. Smith Enterprise needs someone to supply it with 125,000 cartons of machine screws per year to support its manufacturing needs over the next 5 years, and you've decided to bid on the contract. It will cost you $720,000 to install the equipment necessary to start production; you'll depreciate this cost straight-line to zero over the project's life. You estimate that in 5 years, this equipment can be salvaged for $50,000 (before tax). Your fixed production costs will be $285,000 per year, and your variable production costs should be $10.5 per carton. You also need an initial investment in net working capital of $70,000. If your tax rate is 30 percent and you require a 12 percent return on your investment, what is our proper bid price per carton? 2. You are evaluating two different silicon wafer milling machines. Machine I costs $120,000, has a 3-year life, and has pretax operating costs of $43,000 per year. Machine Il costs $160,000, has a 5-year life, and has pretax operating costs of $20,000 per year. For both machines, use straight-line depreciation to zero over the project's life and assume a salvage value of $20,000. If your tax rate is 34 percent and your discount rate is 12 percent, which one do you prefer to buy, Machine I or Machine II? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts