Question: Exercise 8-10 (Static) Analyze and record deferred revenues (LO8-4) Apple incorporated Is one of the top online music retailers through its iTunes music store. Assume

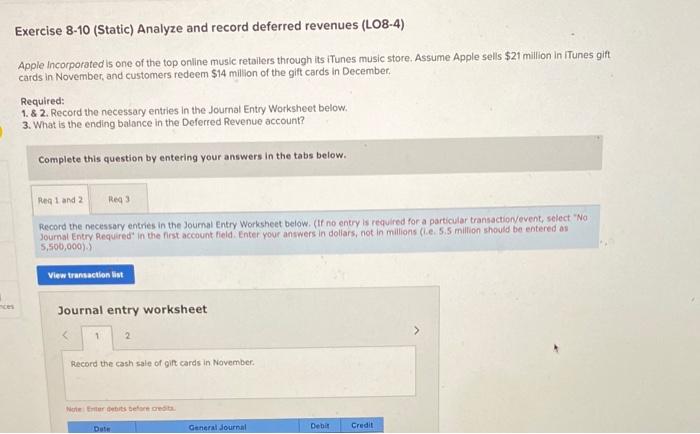

Exercise 8-10 (Static) Analyze and record deferred revenues (LO8-4) Apple incorporated Is one of the top online music retailers through its iTunes music store. Assume Apple sells $21 million in iTunes gift cards in November, and customers redeem $14 million of the gift cards in December. Required: 1. \& 2. Record the necessary entries in the Journal Entry Worksheet below. 3. What is the ending balance in the Deferred Revenue account? Complete this question by entering your answers in the tabs below. Record the necessary entries in the Joumal Entry Worksheet below. (If no entry is required for a particular transactionyevent, select "No Journal Entry Required" in the first account field. Enter your answers in doliars, not in millions fi.e. 5.5 million should be entered as 5,500,000)3 Journal entry worksheet 2 Record the cash sale of gitt cards in November. Wolle triter genits before aresta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts