Question: Exercise 8-10A (Static) Loss on Constructive Retirement (Straight-Line Method) LO 8-2 Par Corporation holds 60 percent of Short Publishing Company's voting shares. Par issued $500,000

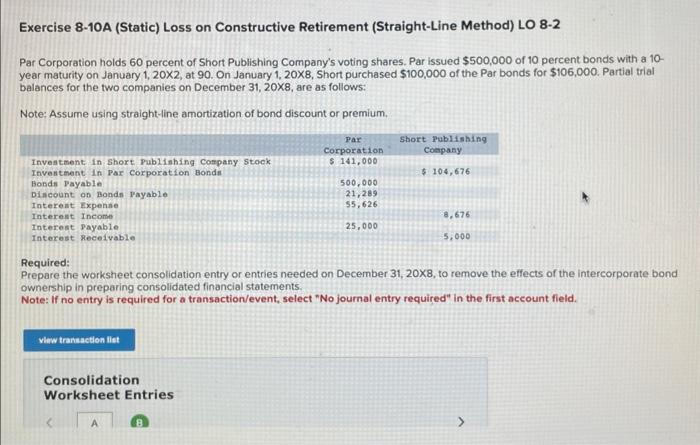

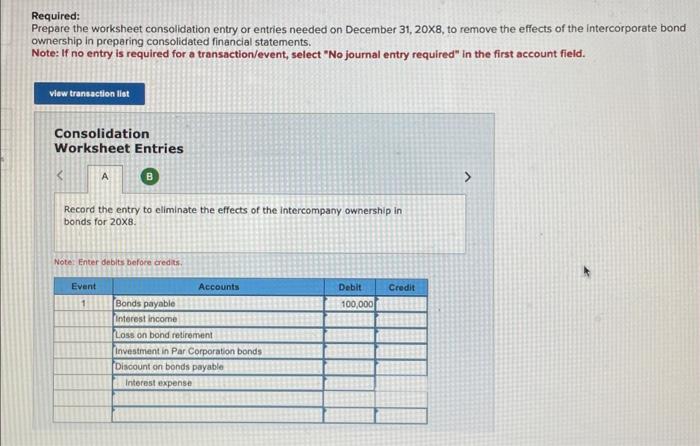

Exercise 8-10A (Static) Loss on Constructive Retirement (Straight-Line Method) LO 8-2 Par Corporation holds 60 percent of Short Publishing Company's voting shares. Par issued $500,000 of 10 percent bonds with a 10 year maturity on January 1,202, at 90 . On January 1,208, Short purchased $100,000 of the Par bonds for $106,000. Partial trial balances for the two companies on December 31,208, are as follows: Note: Assurne using straight-line amortization of bond discount or premium. Required: Prepare the worksheet consolidation entry or entries needed on December 31,208, to remove the effects of the intercorporate bond ownership in preparing consolidated financial statements. Note: if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Required: Prepare the worksheet consolidation entry or entries needed on December 31,208, to remove the effects of the intercorporate bond ownership in preparing consolidated financial statements. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Consolidation Worksheet Entries Record the entry to eliminate the effects of the intercompany ownership in bonds for 208. Note: Enter deblts before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts