Question: Exercise 8-19A Computing and recording depletion expense LO 8-9 Colorado Mining paid $658,000 to acquire a mine with 47.000 tons of coal reserves. The following

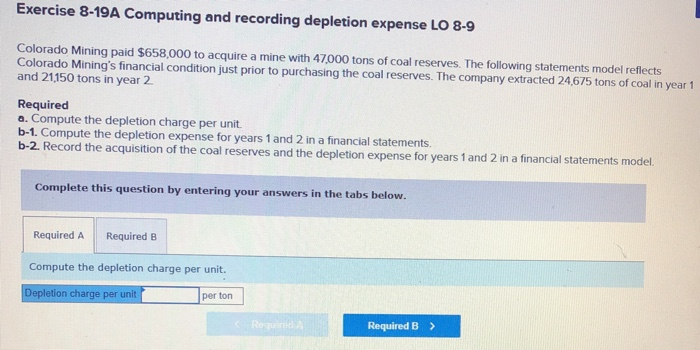

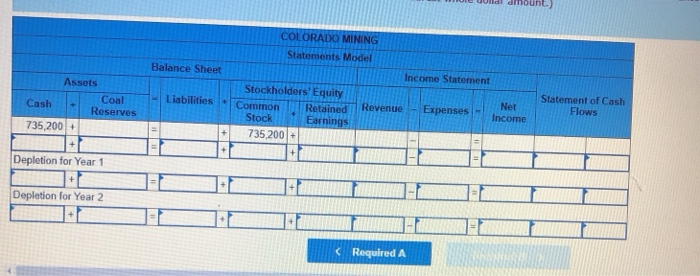

Exercise 8-19A Computing and recording depletion expense LO 8-9 Colorado Mining paid $658,000 to acquire a mine with 47.000 tons of coal reserves. The following statements model reflects Colorado Mining's financial condition just prior to purchasing the coal reserves. The company extracted 24,675 tons of coal in year 1 and 21,150 tons in year 2 Required a. Compute the depletion charge per unit b-1. Compute the depletion expense for years 1 and 2 in a financial statements b-2. Record the acquisition of the coal reserves and the depletion expense for years 1 and 2 in a financial statements model Complete this question by entering your answers in the tabs below. Required A Required B Compute the depletion charge per unit. Deplotion charge per unit per ton REED Required B > COLORADO MINING Statements Model Balance Sheet Income Statement Assets Statement of Cash Flows Liabilities Revenue - Expenses Net Income Coal Reserves Cash Stockholders' Equity Con t ained Stock Earnings 735,200 + 735,200 + Depletion for Year 1 Depletion for Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts