Question: Exercise 8-20 Difference in Operating Income under Absorption and Variable Costing (LO 8-1, 8-4) Manta Ray Company manufactures diving masks with a variable cost

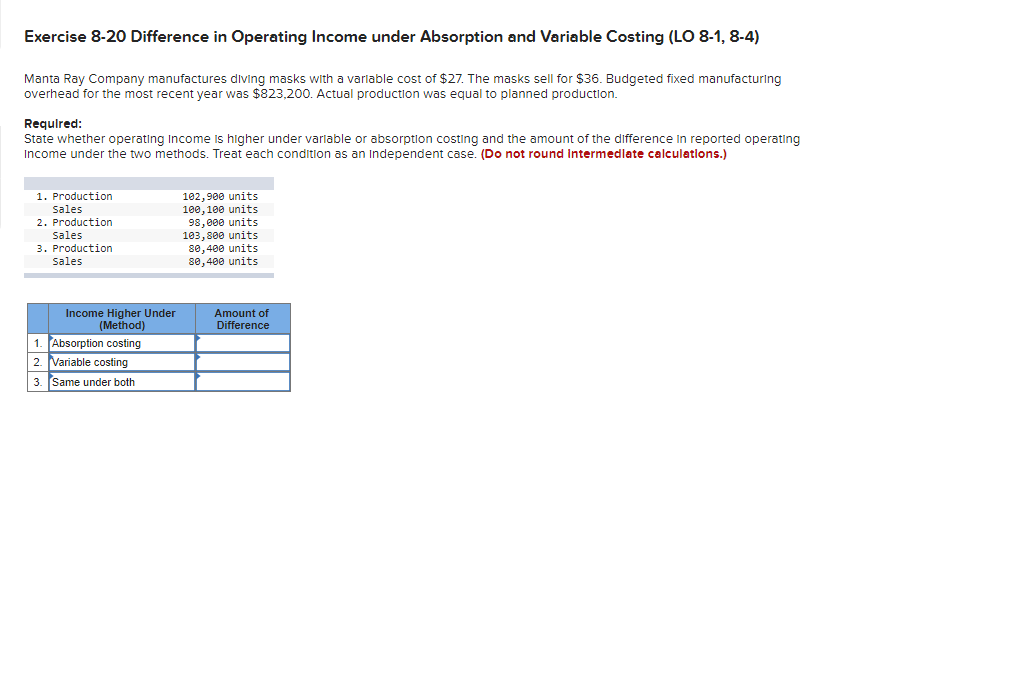

Exercise 8-20 Difference in Operating Income under Absorption and Variable Costing (LO 8-1, 8-4) Manta Ray Company manufactures diving masks with a variable cost of $27. The masks sell for $36. Budgeted fixed manufacturing overhead for the most recent year was $823,200. Actual production was equal to planned production. Required: State whether operating Income is higher under variable or absorption costing and the amount of the difference in reported operating Income under the two methods. Treat each condition as an Independent case. (Do not round intermediate calculations.) 1. Production Sales 2. Production Sales 3. Production Sales 102,900 units 100,100 units 98,000 units 103,800 units 80,400 units 80,400 units Income Higher Under (Method) 1. Absorption costing 2. Variable costing 3. Same under both Amount of Difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts