Question: Exercise 8-24 (Algorithmic) (LO. 5) The Parent consolidated group reports the following results for the tax year. Entity Income or Loss Parent $76,000 Sub1 (7,600)

Exercise 8-24 (Algorithmic) (LO. 5)

The Parent consolidated group reports the following results for the tax year.

|

Do not round any division in your computations. If required, round your answers to nearest whole dollar. If an amount is zero, enter "0".

a. What is the group's consolidated taxable income and consolidated tax liability?

If the relative taxable income method, the consolidated taxable income is $114,000 and the total consolidated tax liability is $23,940

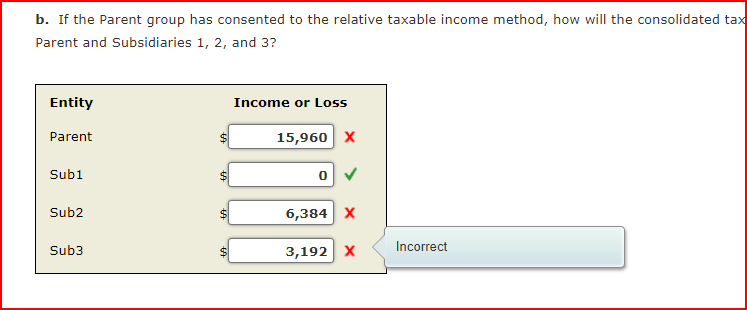

b. If the Parent group has consented to the relative taxable income method, how will the consolidated tax liability be allocated among the Parent and Subsidiaries 1, 2, and 3?

b. If the Parent group has consented to the relative taxable income method, how will the consolidated tax Parent and Subsidiaries 1, 2, and 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts