Question: Exercise 8-24 Difference in Operating Income under Absorption and Variable Costing (LO 8-1, 8-4) Blanca Bicycle Company manufactures mountain bikes with a variable cost of

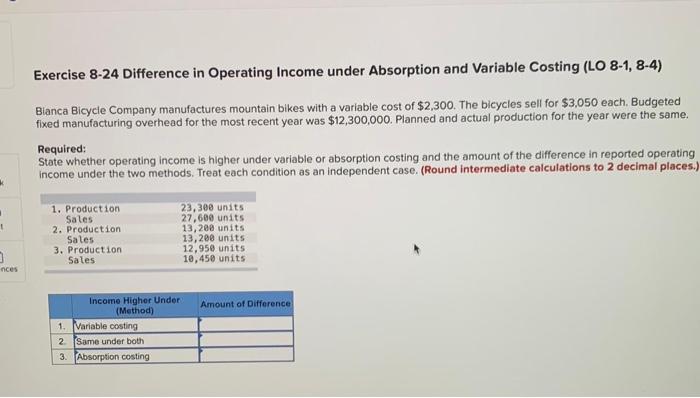

Exercise 8-24 Difference in Operating Income under Absorption and Variable Costing (LO 8-1, 8-4) Blanca Bicycle Company manufactures mountain bikes with a variable cost of $2,300. The bicycles sell for $3,050 each, Budgeted fixed manufacturing overhead for the most recent year was $12,300,000. Planned and actual production for the year were the same. Required: State whether operating income is higher under variable or absorption costing and the amount of the difference in reported operating income under the two methods. Treat each condition as an independent case. (Round intermediate calculations to 2 decimal places.) 1. Production Sales 2. Production Sales 3. Production Sales 23,300 units 27,600 units 13,208 units 13,208 units 12,950 units 10,450 units nces Amount of Difference Income Higher Under (Method) 1. Variable costing 2 Same under both 3. Absorption costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts