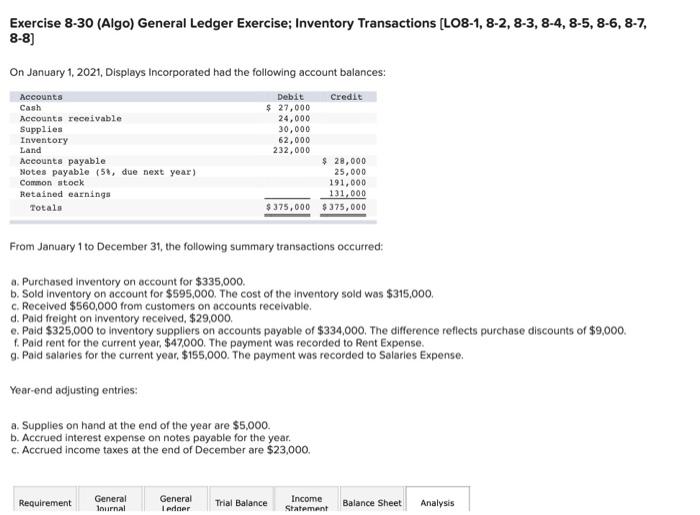

Question: Exercise 8-30 (Algo) General Ledger Exercise; Inventory Transactions [LO8-1, 8-2, 8-3, 8-4, 8-5, 8-6, 8-7, 88] On January 1, 2021, Displays Incorporated had the following

![8-4, 8-5, 8-6, 8-7, 88] On January 1, 2021, Displays Incorporated had](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e856f3dcc45_64366e856f37b1c3.jpg)

Exercise 8-30 (Algo) General Ledger Exercise; Inventory Transactions [LO8-1, 8-2, 8-3, 8-4, 8-5, 8-6, 8-7, 88] On January 1, 2021, Displays Incorporated had the following account balances: From January 1 to December 31 , the following summary transactions occurred: a. Purchased inventory on account for $335,000. b. Sold inventory on account for $595,000. The cost of the inventory sold was $315,000. c. Received $560,000 from customers on accounts recelvable. d. Paid freight on inventory received, $29,000. e. Paid $325,000 to inventory suppliers on accounts payable of $334,000. The difference reflects purchase discounts of $9,000. f. Paid rent for the current year, $47,000. The payment was recorded to Rent Expense. g. Paid salaries for the current year, $155,000. The payment was recorded to Salaries Expense. Year-end adjusting entries: a. Supplies on hand at the end of the year are $5,000. b. Accrued interest expense on notes payable for the year. c. Accrued income taxes at the end of December are $23,000. Using the information from the requirements above, complete the 'Analysis'. (Calculate the ratios to the nearest 1 decim

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts