Question: Exercise 8-65 (Algorithmic) Accrued Liabilities Wemple Audio & Video had the following items that require adjusting entries at the end of the year. a. Wemple

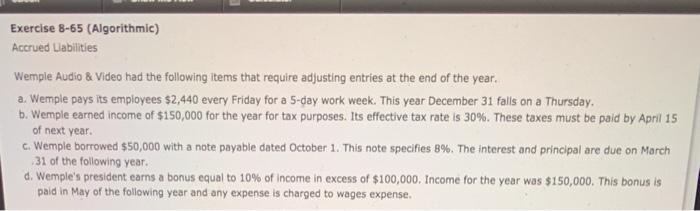

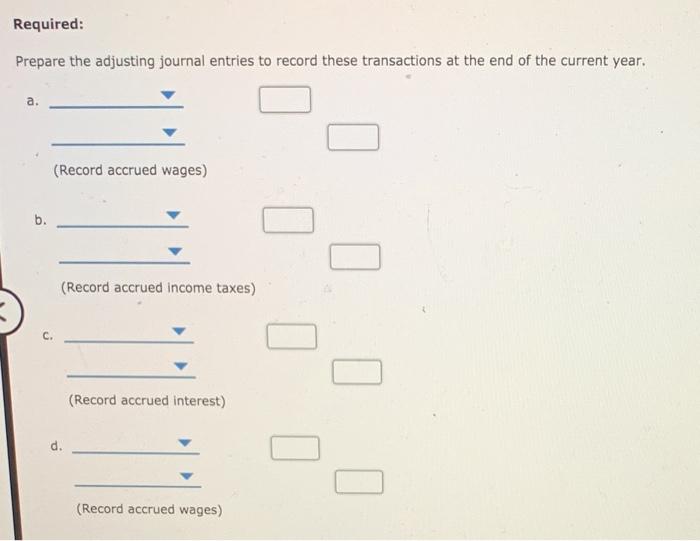

Exercise 8-65 (Algorithmic) Accrued Liabilities Wemple Audio & Video had the following items that require adjusting entries at the end of the year. a. Wemple pays its employees $2,440 every Friday for a 5-day work week. This year December 31 falls on a Thursday, b. Wemple earned income of $150,000 for the year for tax purposes. Its effective tax rate is 30%. These taxes must be paid by April 15 of next year. c. Wemple borrowed $50,000 with a note payable dated October 1. This note specifies 8%. The interest and principal are due on March :31 of the following year. d. Wemple's president earns a bonus equal to 10% of income in excess of $100,000. Income for the year was $150,000. This bonus is paid in May of the following year and any expense is charged to wages expense. Required: Prepare the adjusting journal entries to record these transactions at the end of the current year. a. (Record accrued wages) b. (Record accrued income taxes) (Record accrued interest) d . (Record accrued wages)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts