Question: Exercise 8-8 (Algorithmic) (LO. 6, 7) Shannon owns two items of business equipment. Both were purchased in 2017 for $175,200, both have a 7-year

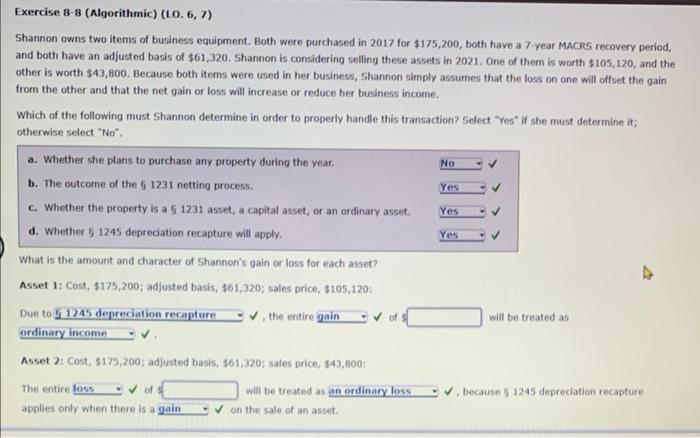

Exercise 8-8 (Algorithmic) (LO. 6, 7) Shannon owns two items of business equipment. Both were purchased in 2017 for $175,200, both have a 7-year MACRS recovery period, and both have an adjusted basis of $61,320. Shannon is considering selling these assets in 2021. One of them is worth $105,120, and the other is worth $43,800. Because both items were used in her business, Shannon simply assumes that the loss on one will offset the gain from the other and that the net gain or loss will increase or reduce her business income. Which of the following must Shannon determine in order to properly handle this transaction? Select "Yes" if she must determine it; otherwise select "No". a. Whether she plans to purchase any property during the year. b. The outcome of the 5 1231 netting process. No Yes c. Whether the property is a 1231 asset, a capital asset, or an ordinary asset. Yes d. Whether 5 1245 depreciation recapture will apply. Yes What is the amount and character of Shannon's gain or loss for each asset? Asset 1: Cost, $175,200; adjusted basis, $61,320; sales price, $105,120: , the entire gain will be treated as Due to 1245 depreciation recapture ordinary income Asset 2: Cost, $175,200; adjusted basis, $61,320; sales price, $43,800: The entire loss of applies only when there is a gain will be treated as an ordinary loss on the sale of an asset. , because 5 1245 depreciation recapture

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts