Question: Exercise 9 ABC Ltd. (VAT payer) Balance sheet items on 01.10 are: 1. Licences - EUR 4 000, 2. Amortization of Intangible investments - EUR

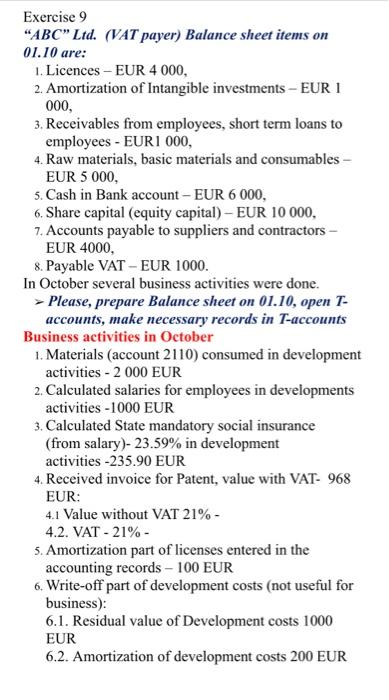

Exercise 9 "ABC" Ltd. (VAT payer) Balance sheet items on 01.10 are: 1. Licences - EUR 4 000, 2. Amortization of Intangible investments - EUR 1 000, 3. Receivables from employees, short term loans to employees - EUR1 000, 4. Raw materials, basic materials and consumables - EUR 5 000, 5. Cash in Bank account - EUR 6 000, 6. Share capital (equity capital) - EUR 10 000, 7. Accounts payable to suppliers and contractors - EUR 4000, 8. Payable VAT - EUR 1000. In October several business activities were done. > Please, prepare Balance sheet on 01.10, open T- accounts, make necessary records in T-accounts Business activities in October 1. Materials (account 2110) consumed in development activities - 2 000 EUR 2. Calculated salaries for employees in developments activities -1000 EUR 3. Calculated State mandatory social insurance (from salary)- 23.59% in development activities -235.90 EUR 4. Received invoice for Patent, value with VAT- 968 EUR: 4.1 Value without VAT 21%- 4.2. VAT - 21% - 5. Amortization part of licenses entered in the accounting records - 100 EUR 6. Write-off part of development costs (not useful for business): 6.1. Residual value of Development costs 1000 EUR 6.2. Amortization of development costs 200 EUR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts