Question: Exercise 9 Consider a small, open economy that has a nominal exchange rate fixed at S=5 pesos/dol- lar. In this economy, the La Union Bank

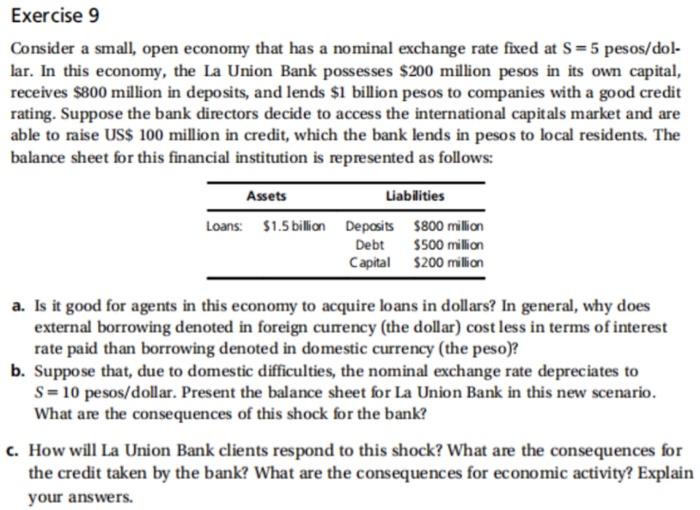

Exercise 9 Consider a small, open economy that has a nominal exchange rate fixed at S=5 pesos/dol- lar. In this economy, the La Union Bank possesses $200 million pesos in its own capital, receives $800 million in deposits, and lends $1 billion pesos to companies with a good credit rating. Suppose the bank directors decide to access the international capitals market and are able to raise US$ 100 million in credit, which the bank lends in pesos to local residents. The balance sheet for this financial institution is represented as follows: Assets Liabilities Loans: $1.5 billion Deposits $800 million Debt $500 million Capital $200 million a. Is it good for agents in this economy to acquire loans in dollars? In general, why does external borrowing denoted in foreign currency (the dollar) cost less in terms of interest rate paid than borrowing denoted in domestic currency (the peso)? b. Suppose that, due to domestic difficulties, the nominal exchange rate depreciates to S= 10 pesos/dollar. Present the balance sheet for La Union Bank in this new scenario. What are the consequences of this shock for the bank? C. How will La Union Bank clients respond to this shock? What are the consequences for the credit taken by the bank? What are the consequences for economic activity? Explain your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts