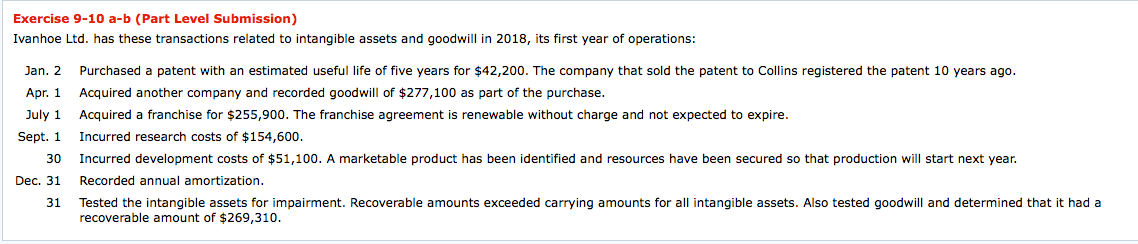

Question: Exercise 9-10 a-b (Part Level Submission) Ivanhoe Ltd. has these transactions related to intangible assets and goodwill in 2018, its first year of operations: Jan.

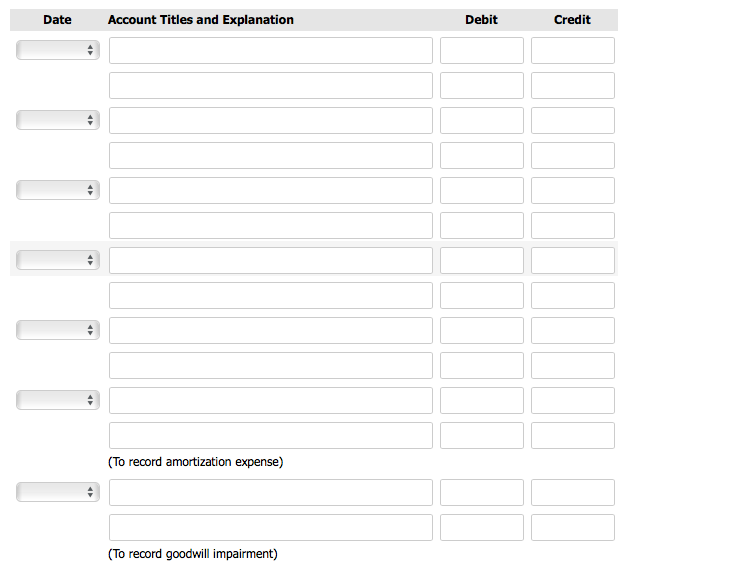

Exercise 9-10 a-b (Part Level Submission) Ivanhoe Ltd. has these transactions related to intangible assets and goodwill in 2018, its first year of operations: Jan. 2 Apr. 1 July 1 Sept. 1 30 Dec. 31 31 Purchased a patent with an estimated useful life of five years for $42,200. The company that sold the patent to Collins registered the patent 10 years ago. Acquired another company and recorded goodwill of $277,100 as part of the purchase. Acquired a franchise for $255,900. The franchise agreement is renewable without charge and not expected to expire. Incurred research costs of $154,600. Incurred development costs of $51,100. A marketable product has been identified and resources have been secured so that production will start next year. Recorded annual amortization. Tested the intangible assets for impairment. Recoverable amounts exceeded carrying amounts for all intangible assets. Also tested goodwill and determined that it had a recoverable amount of $269,310. Date Account Titles and Explanation Debit Credit (To record amortization expense) (To record goodwill impairment)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts