Question: Exercise 9-12 Notes receivable transactions C2 Prepare journal entries for the following transactions of Danica Company. Dec. 13 Accepted a $9.500.45-day, 8% note in granting

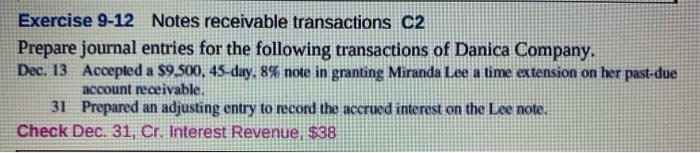

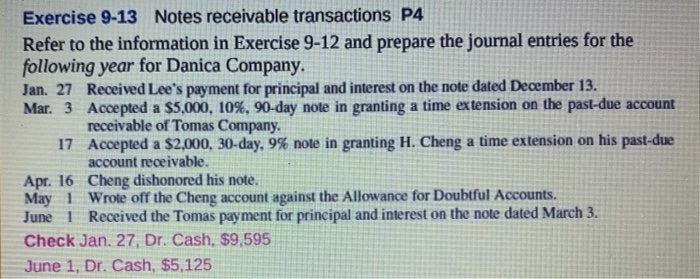

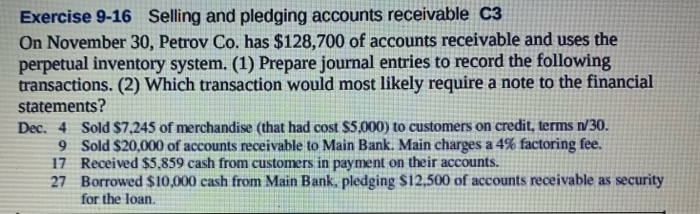

Exercise 9-12 Notes receivable transactions C2 Prepare journal entries for the following transactions of Danica Company. Dec. 13 Accepted a $9.500.45-day, 8% note in granting Miranda Lee a time extension on her past-due account receivable. 31 Prepared an adjusting entry to record the accrued interest on the Lee note. Check Dec. 31. Cr. Interest Revenue, $38 Exercise 9-13 Notes receivable transactions P4 Refer to the information in Exercise 9-12 and prepare the journal entries for the following year for Danica Company. Jan. 27 Received Lee's payment for principal and interest on the note dated December 13. Mar. 3 Accepted a $5,000, 10%, 90-day note in granting a time extension on the past-due account receivable of Tomas Company. 17 Accepted a $2,000, 30-day, 9% note in granting H. Cheng a time extension on his past-due account receivable. Apr. 16 Cheng dishonored his note. May I Wrote off the Cheng account against the Allowance for Doubtful Accounts. June 1 Received the Tomas payment for principal and interest on the note dated March 3. Check Jan. 27. Dr. Cash, $9,595 June 1, Dr. Cash, $5,125 Exercise 9-16 Selling and pledging accounts receivable C3 On November 30, Petrov Co. has $128,700 of accounts receivable and uses the perpetual inventory system. (1) Prepare journal entries to record the following transactions. (2) Which transaction would most likely require a note to the financial statements? Dec. 4 Sold $7,245 of merchandise (that had cost $5,000) to customers on credit, terms 1/30. 9 Sold $20,000 of accounts receivable to Main Bank. Main charges a 4% factoring fee. 17 Received $5.859 cash from customers in payment on their accounts. 27 Borrowed $10,000 cash from Main Bank, pledging $12,500 of accounts receivable as security for the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts