Question: Exercise 9-12 Your answer is partially correct. Try again. Kirkland Company combines its operating expenses for budget purposes in a selling and administrative expense budget.

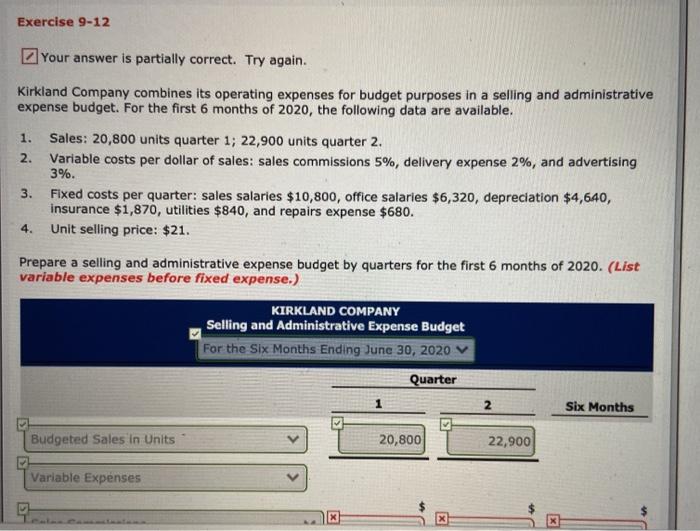

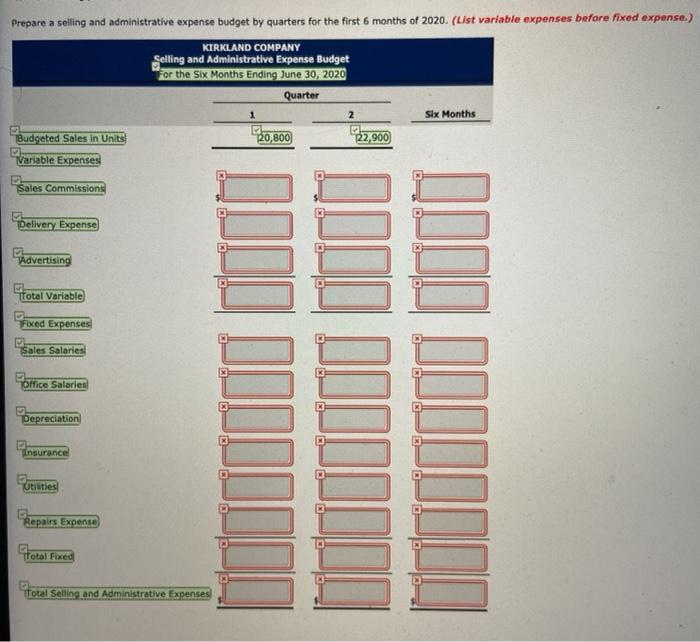

Exercise 9-12 Your answer is partially correct. Try again. Kirkland Company combines its operating expenses for budget purposes in a selling and administrative expense budget. For the first 6 months of 2020, the following data are available. 1. 2. Sales: 20,800 units quarter 1; 22,900 units quarter 2. Variable costs per dollar of sales: sales commissions 5%, delivery expense 2%, and advertising 3%. Fixed costs per quarter: sales salaries $10,800, office salaries $6,320, depreciation $4,640, insurance $1,870, utilities $840, and repairs expense $680. Unit selling price: $21. 3. 4. Prepare a selling and administrative expense budget by quarters for the first 6 months of 2020. (List variable expenses before fixed expense.) KIRKLAND COMPANY Selling and Administrative Expense Budget For the Six Months Ending June 30, 2020 V Quarter 1 2 Six Months Budgeted Sales in Units 20,800 22,900 Variable Expenses Prepare a selling and administrative expense budget by quarters for the first 6 months of 2020. (List variable expenses before fixed expense.) KIRKLAND COMPANY Selling and Administrative Expense Budget For the Six Months Ending June 30, 2020 Quarter 1 2 Six Months Budgeted Sales in Units 20,800 22,900 Variable Expenses Sales Commissions Delivery Expense TAdvertising total variable Fixed Expenses Sales Salaries Office Salaries budaldaa budd boulodda oddi Depreciation Insurance M titties Repairs Expense Total Fixed Stotal Selling and Adeninistrative Expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts