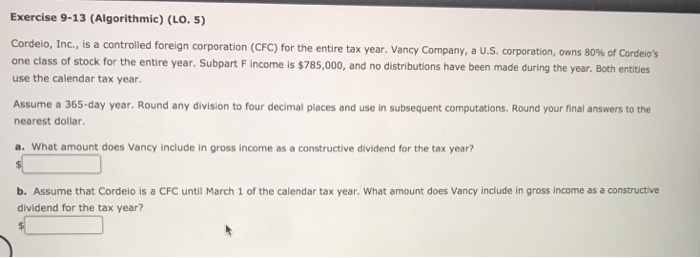

Question: Exercise 9-13 (Algorithmic) (LO. 5) Cordeio, Inc., is a controlled foreign corporation (CFC) for the entire tax year. one class of stock for the entire

Exercise 9-13 (Algorithmic) (LO. 5) Cordeio, Inc., is a controlled foreign corporation (CFC) for the entire tax year. one class of stock for the entire year. Subpart F income is $785,000, and no distributions have been made during the year. Both entities use the calendar tax year. Assume a 365-day year. Round any division to four decimal places and use in subsequent computations. Round your final answers to the nearest dollar, Vancy Company, a U.S. corporation, owns 80% of Cordeios a. What amount does Vancy include in gross income as a constructive dividend for the tax year? b. Assume that Cordeio is a CFC until March 1 of the calendar tax year. What amount does Vancy include in gross income as a constructive dividend for the tax year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts