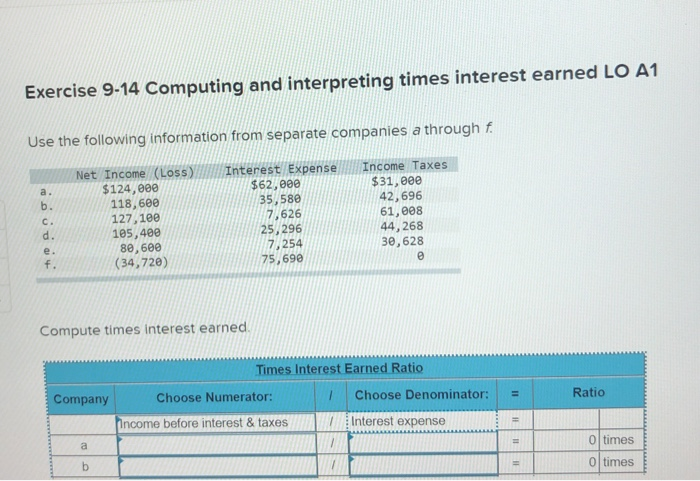

Question: Exercise 9-14 Computing and interpreting times interest earned LO A1 Use the following information from separate companies a through f. ;; Net Income (Loss) $124,000

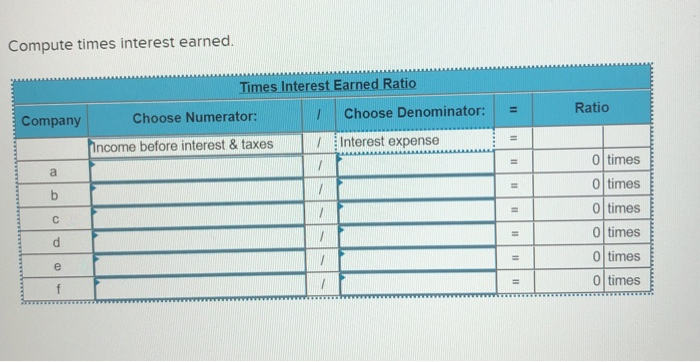

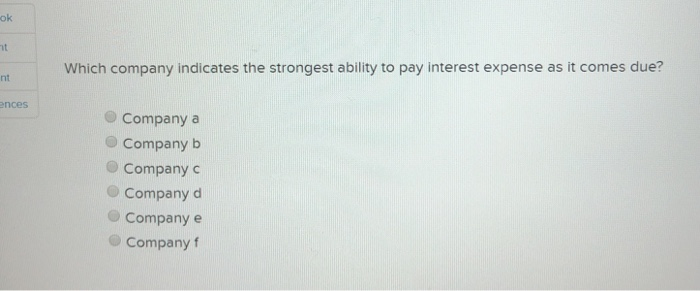

Exercise 9-14 Computing and interpreting times interest earned LO A1 Use the following information from separate companies a through f. ;; Net Income (Loss) $124,000 118,600 127,180 105,400 80,600 (34,720) Interest Expense $62,000 35,580 7,626 25, 296 7,254 75,690 Income Taxes $31,000 42,696 61,008 44,268 30, 628 Compute times interest earned. Times Interest Earned Ratio Choose Numerator: 1 Choose Denominator: Company Ratio income before interest & taxes : Interest expense 0 times 0 times Compute times interest earned. Company Times Interest Earned Ratio Choose Numerator: Choose Denominator: income before interest & taxes Interest expense Ratio b 11 0 times 0 times O times 0 times 0 times 0 times Which company indicates the strongest ability to pay interest expense as it comes due? inces Company a Company b Company c Company d Company e Company f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts