Question: Exercise 9-15B Transfer pricing and fixed cost per unit The Nashua Division of Leland Company currently produces electric fans that desktop computer manufacturers use as

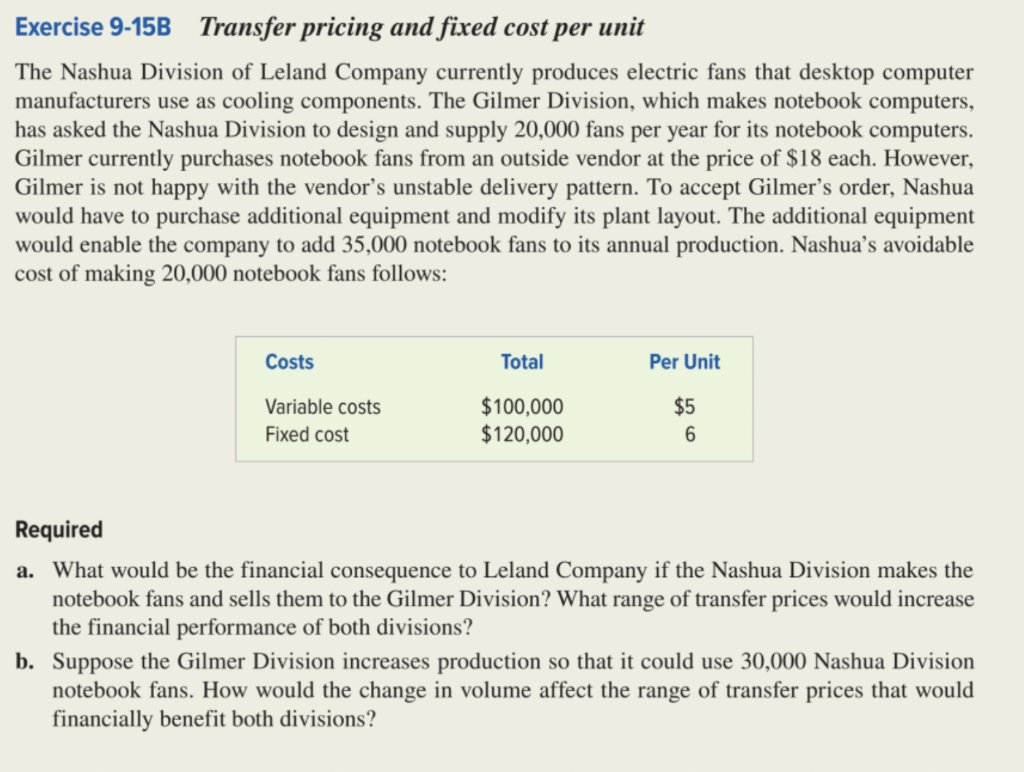

Exercise 9-15B Transfer pricing and fixed cost per unit The Nashua Division of Leland Company currently produces electric fans that desktop computer manufacturers use as cooling components. The Gilmer Division, which makes notebook computers, has asked the Nashua Division to design and supply 20,000 fans per year for its notebook computers. Gilmer currently purchases notebook fans from an outside vendor at the price of $18 each. However, Gilmer is not happy with the vendor's unstable delivery pattern. To accept Gilmer's order, Nashua would have to purchase additional equipment and modify its plant layout. The additional equipment would enable the company to add 35,000 notebook fans to its annual production. Nashua's avoidable cost of making 20,000 notebook fans follows: Required a. What would be the financial consequence to Leland Company if the Nashua Division makes the notebook fans and sells them to the Gilmer Division? What range of transfer prices would increase the financial performance of both divisions? b. Suppose the Gilmer Division increases production so that it could use 30,000 Nashua Division notebook fans. How would the change in volume affect the range of transfer prices that would financially benefit both divisions? Exercise 9-15B Transfer pricing and fixed cost per unit The Nashua Division of Leland Company currently produces electric fans that desktop computer manufacturers use as cooling components. The Gilmer Division, which makes notebook computers, has asked the Nashua Division to design and supply 20,000 fans per year for its notebook computers. Gilmer currently purchases notebook fans from an outside vendor at the price of $18 each. However, Gilmer is not happy with the vendor's unstable delivery pattern. To accept Gilmer's order, Nashua would have to purchase additional equipment and modify its plant layout. The additional equipment would enable the company to add 35,000 notebook fans to its annual production. Nashua's avoidable cost of making 20,000 notebook fans follows: Required a. What would be the financial consequence to Leland Company if the Nashua Division makes the notebook fans and sells them to the Gilmer Division? What range of transfer prices would increase the financial performance of both divisions? b. Suppose the Gilmer Division increases production so that it could use 30,000 Nashua Division notebook fans. How would the change in volume affect the range of transfer prices that would financially benefit both divisions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts