Question: Exercise 9-17 Danny Bostic is evaluating a new ticketing system for his theater. The system will cost $295,360 and will save the theater $57,640 in

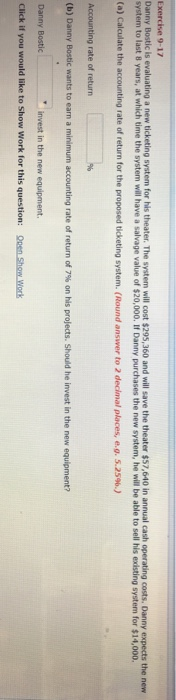

Exercise 9-17 Danny Bostic is evaluating a new ticketing system for his theater. The system will cost $295,360 and will save the theater $57,640 in annual cash operating costs. Danny expects the new system to last 8 years, at which time the system will have a salvage value of $20,000. If Danny purchases the new system, he will be able to sell his existing system for $14,000. (a) Calculate the accounting rate of return for the proposed ticketing system. (Round answer to 2 decimal places, eg. 5.25%.) (b) Danny Bostic wants to earn a minimum accounting rate of return of 7% on his projects. Should he invest in the new equipment? Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts