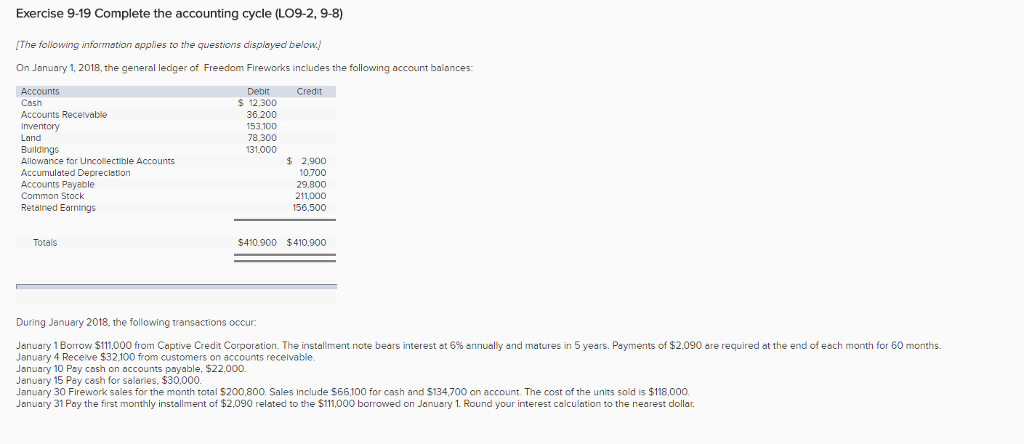

Question: Exercise 9-19 Complete the accounting cycle (LO9-2, 9-8) IThe following information applies to the questions displayed below:/ On January 1, 2018, the general ledger of

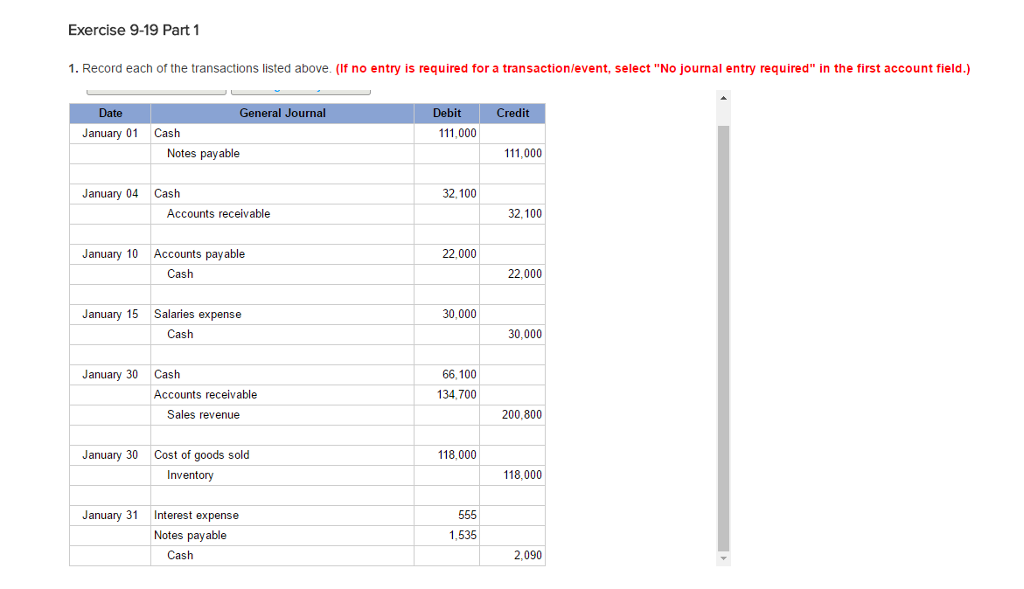

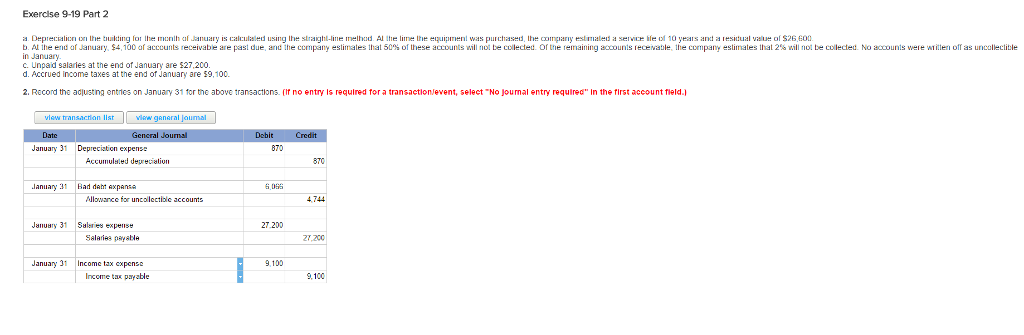

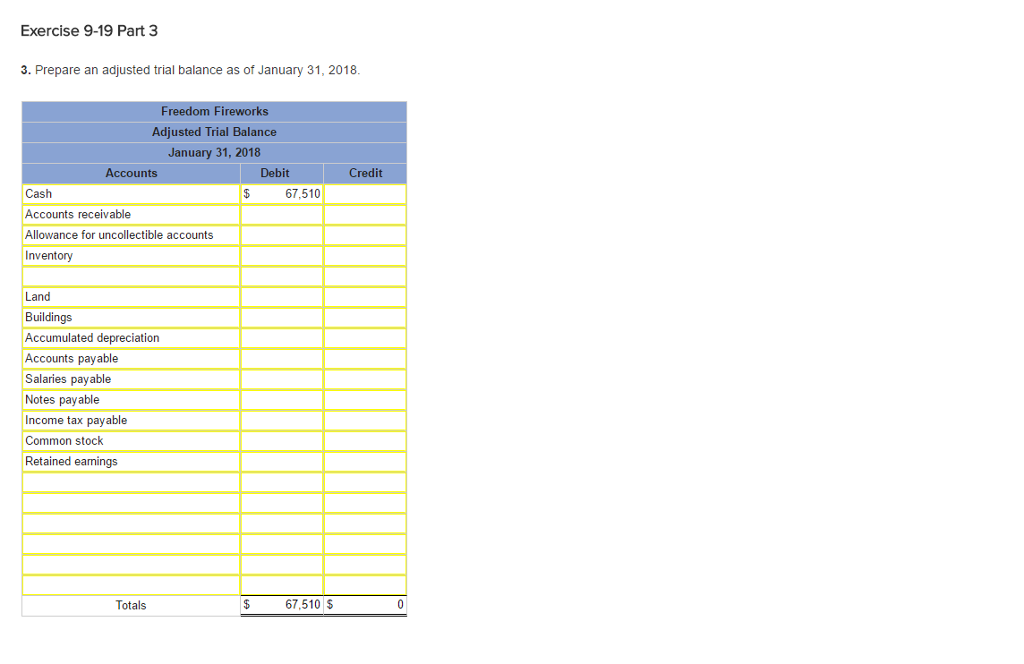

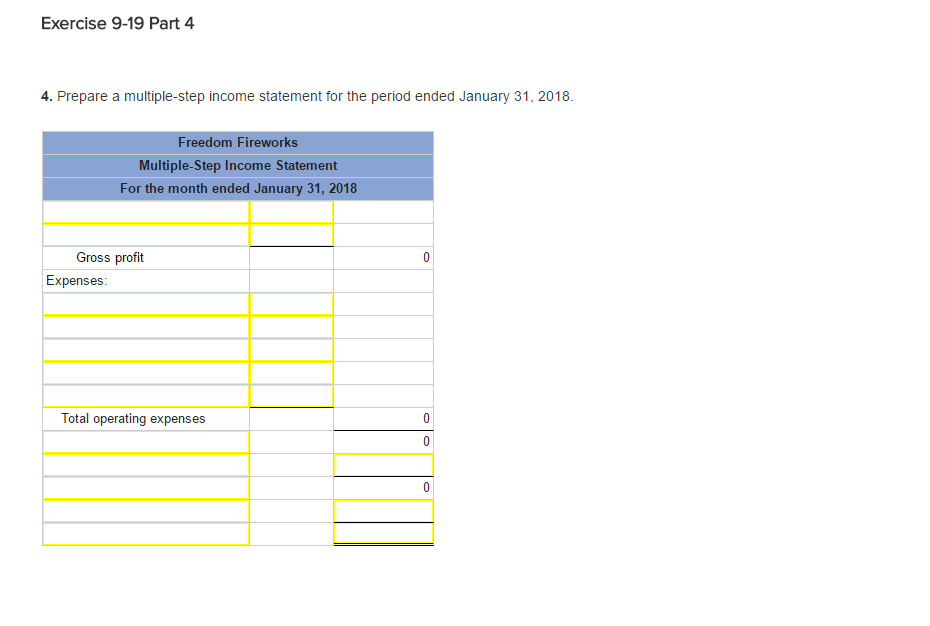

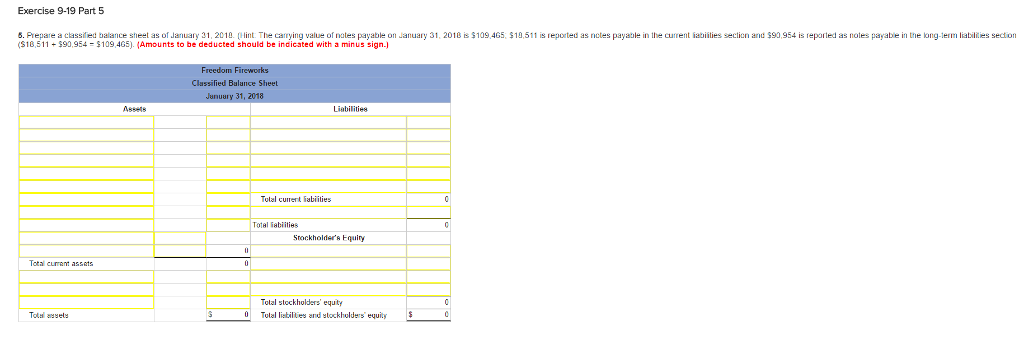

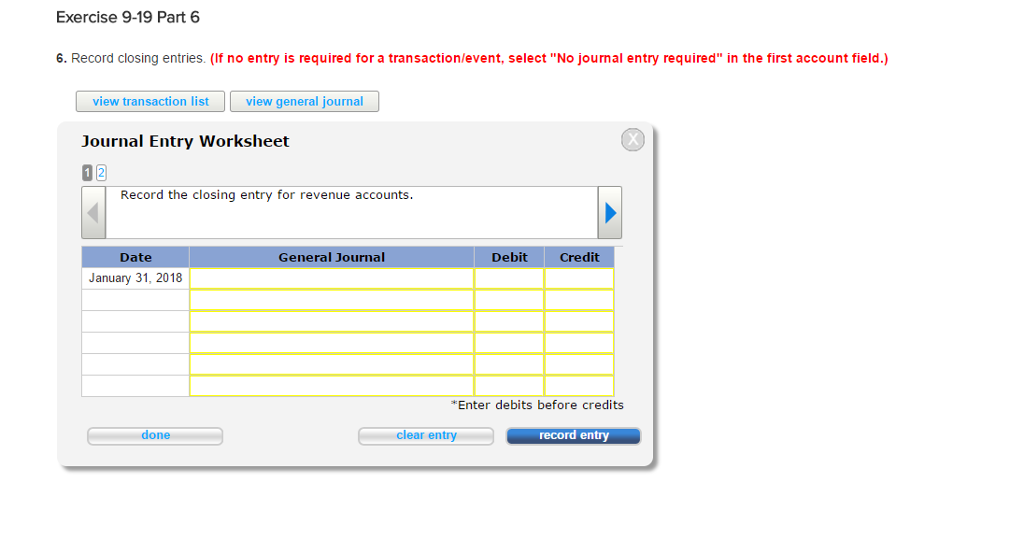

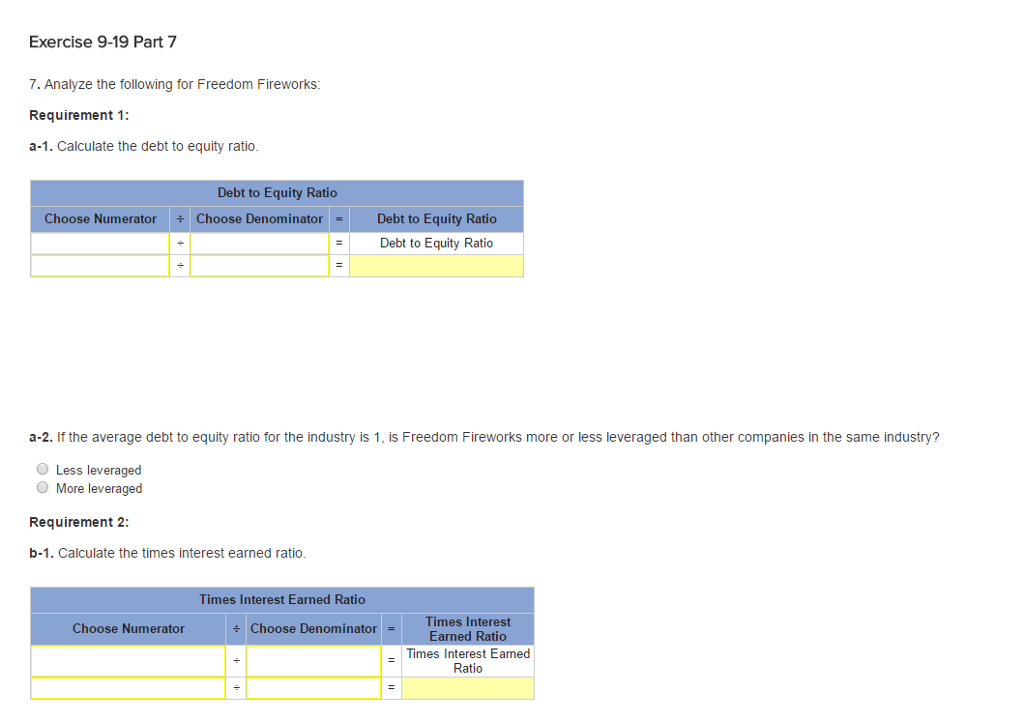

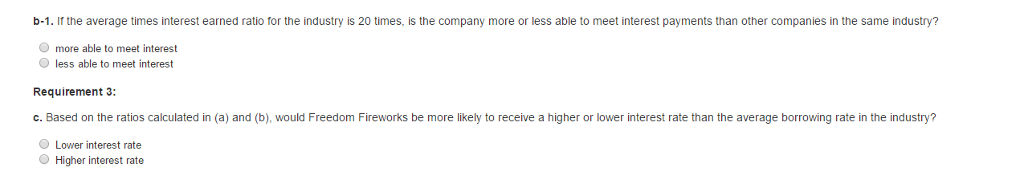

Exercise 9-19 Complete the accounting cycle (LO9-2, 9-8) IThe following information applies to the questions displayed below:/ On January 1, 2018, the general ledger of Freedom Fireworks includes the following account balances: Credit Accounts 12,300 36.200 Accounts. Recelvable 153100 Inventory Land 78,300 Buildings 131.000 Allowance for Uncollectible Accounts 2,900 10,700 Accum ulated Depreclation Accounts Payable 29.800 Common Stock 211,000 Retained Earnings 56.500 $410.900 $410.900 During January 2018. the following transactions occur: January 1Borrow $111,000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments of $2.090 are required at the end of each month for 60 months. January 4 Receive $32.100 from customers on accounts receivable. January 10 Pay cash on accounts payable, $22,000. January 15 Pay cash for salaries. $30,000. January 30 Firework sales for the month total $200,800. Sales include $66100 for cash and$134,700 on account. The cost of the units sold is $118,000 January 31 Pay the first monthly installment of $2,090 related to the $111,000 borrowed on January 1. Round your interest calculation to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts