Question: Exercise 9-2 Recording known current liabilities LO C2 1. On July 15, Piper Co. sold $22.000 of merchandise (costing $11.000) for cash The sales tax

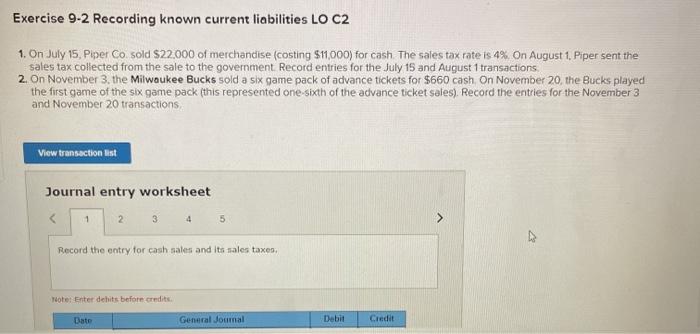

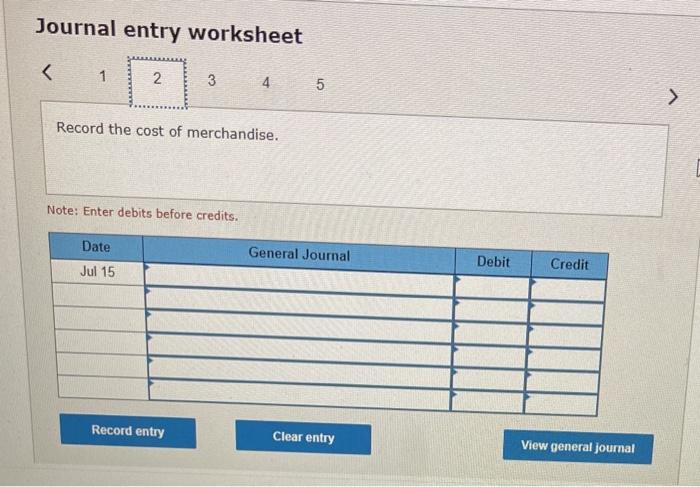

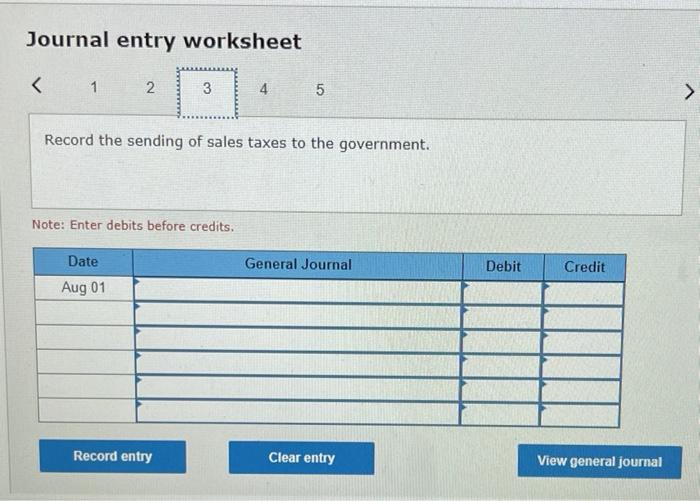

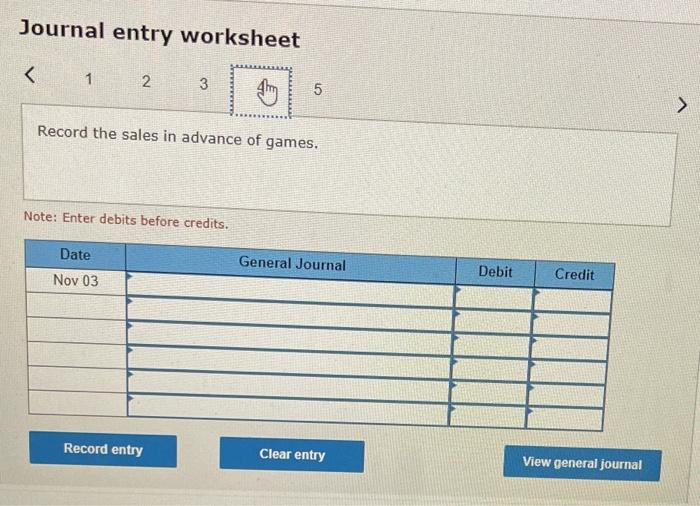

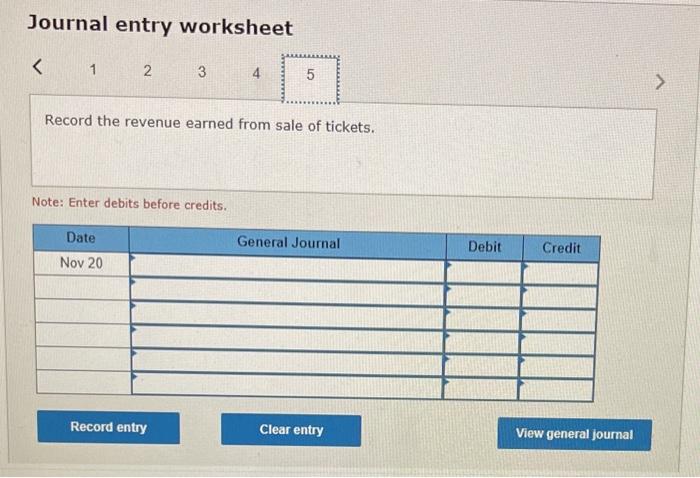

Exercise 9-2 Recording known current liabilities LO C2 1. On July 15, Piper Co. sold $22.000 of merchandise (costing $11.000) for cash The sales tax rate is 4% on August 1. Piper sent the sales tax collected from the sale to the government Record entries for the July 15 and August 1 transactions 2. On November 3, the Milwaukee Bucks sold a six game pack of advance tickets for $660 cash On November 20, the Bucks played the first game of the six game pack (this represented one-sixth of the advance ticket sales). Record the entries for the November 3 and November 20 transactions View transaction ist Journal entry worksheet 3 4 5 1 2 Record the entry for cash sales and its sales taxes. Tote: Enter dehits before credits Date General Journal Debit Credit Journal entry worksheet Record the cost of merchandise. Note: Enter debits before credits. Date General Journal Debit Credit Jul 15 Record entry Clear entry View general journal Journal entry worksheet Record the sending of sales taxes to the government. Note: Enter debits before credits. General Journal Debit Credit Date Aug 01 Record entry Clear entry View general journal Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts