Question: Exercise 9-2 Recording known current liabilities LO C2 Listed below are a few transactions and events of Piper Company. 1. Piper Company records a year-end

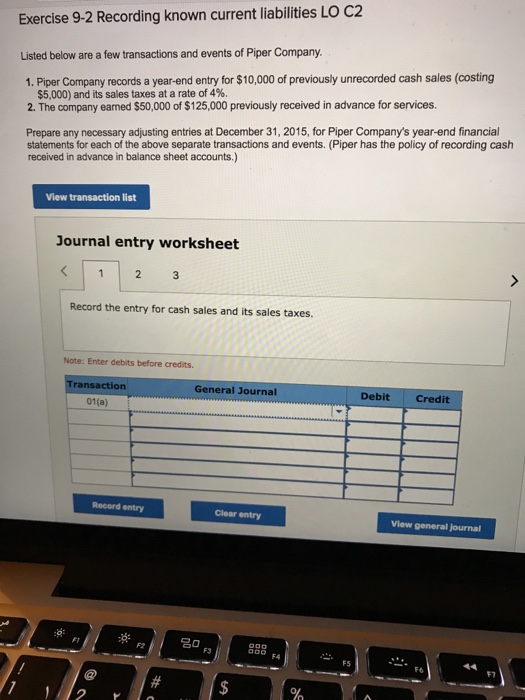

Exercise 9-2 Recording known current liabilities LO C2 Listed below are a few transactions and events of Piper Company. 1. Piper Company records a year-end entry for $10,000 of previously unrecorded cash sales (costing $5,000) and its sales taxes at a rate of 4%. 2. The company eamed $50,000 of $125,000 previously received in advance for services. Prepare any necessary adjusting entries at December 31, 2015, for Piper Company's year-end financial statements for each of the above separate transactions and events. (Piper has the policy of recording cash received in advance in balance sheet accounts.) View transaction list Journal entry worksheet Record the entry for cash sales and its sales taxes. Note: Enter debits before credits. Transaction General Journal Debit Credit 01(a) Record entry Clear entry View general journal 0 F2 F3 . FS F6 F7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts