Question: Exercise 9-37 Activity-Based versus Traditional Costing (LO 9-4, 5, 6) Maglie Company manufactures two video game consoles: handheld and home. The handheld consoles are smaller

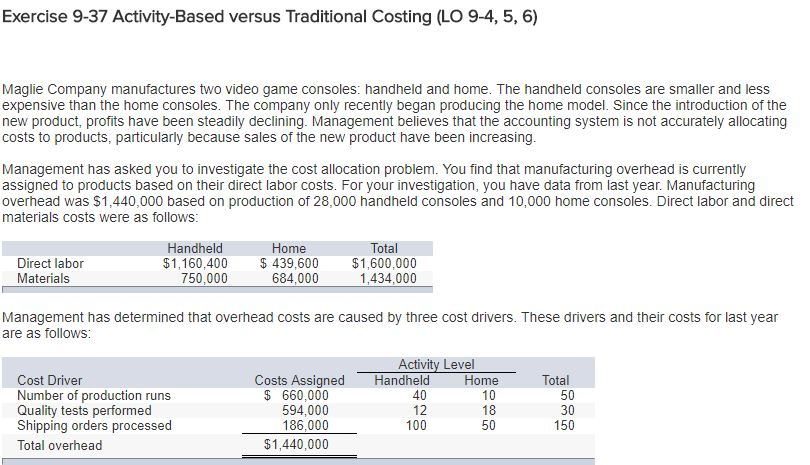

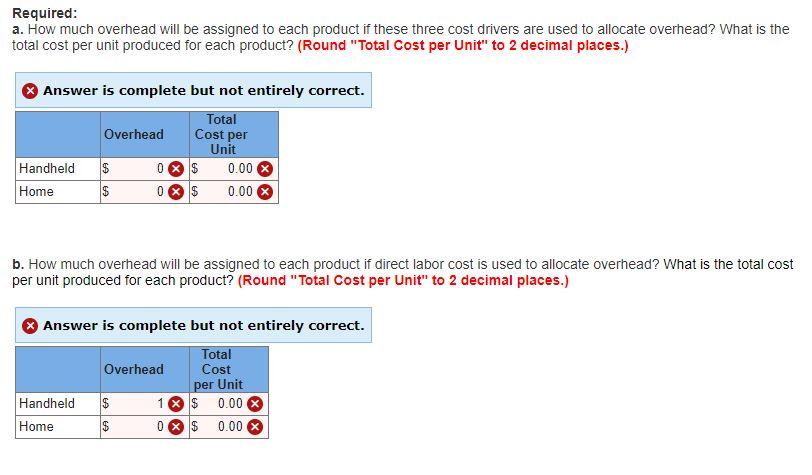

Exercise 9-37 Activity-Based versus Traditional Costing (LO 9-4, 5, 6) Maglie Company manufactures two video game consoles: handheld and home. The handheld consoles are smaller and less expensive than the home consoles. The company only recently began producing the home model. Since the introduction of the new product, profits have been steadily declining. Management believes that the accounting system is not accurately allocating costs to products, particularly because sales of the new product have been increasing Management has asked you to investigate the cost allocation problem. You find that manufacturing overhead is currently assigned to products based on their direct labor costs. For your investigation, you have data from last year. Manufacturing overhead was $1,440,000 based on production of 28,000 handheld consoles and 10,000 home consoles. Direct labor and direct materials costs were as follows Home 439,600 $1,600,000 684,000 Total Direct labor Materials Handheld $1,160,400 750,000 1,434,000 Management has determined that overhead costs are caused by three cost drivers. These drivers and their costs for last year are as follows Act eve Cost Driver Number of production runs Quality tests performed Shi Costs Assigned Handheld Home 10 18 50 $ 660,000 594,000 186,000 $1,440,000 40 12 100 Total 50 30 150 pping orders processed Total overhead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts