Question: Exercise 9-6 Alternative depreciation methodsstraight-line, double-declining-balance, and units-of-production CHECK FIGURES: b. 2019 = $18,300; c. 2020 = $39,560 On January 2, 2017, Wavepoint Systems, a

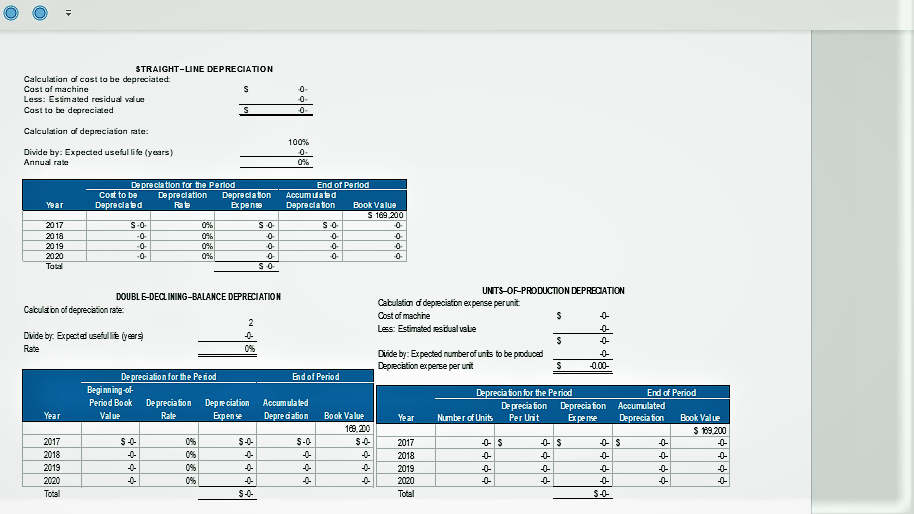

Exercise 9-6 Alternative depreciation methodsstraight-line, double-declining-balance, and units-of-production

CHECK FIGURES: b. 2019 = $18,300; c. 2020 = $39,560

On January 2, 2017, Wavepoint Systems, a cell phone manufacturer, installed a computerized machine in its factory at a cost of $169,200. The machines useful life was estimated at four years or a total of 181,500 units with a $24,000 trade-in value. Wavepoints year-end is December 31. Calculate depreciation for each year of the machines estimated useful life under each of the following methods:

a. Straight-line

b. Double-declining-balance

c. Units-of-production, assuming actual units produced were:

| Year | Actual Units Produced | ||

| 2017 | 38,300 | ||

| 2018 | 41,150 | ||

| 2019 | 52,600 | ||

| 2020 | 56,000 |

STRAIGHT-LINE DEPRECIATION Calcultiarn of cast to be depreciated Cost of machin Less: Esimated residud vd ue Cast to be depreciaed Calcultian of depreciaian rate: 100% Divide by: Expected useful li fe (years) Annua rate De preclation for the Perlod End of Period Cost to be Dapreclation Dprclaton Accumuaed Dspreclated ear Ra Erpene DepreclatonBook Value S 169 200 2018 2019 2020 UNTS-OF-PRODUCTION DEPRECATION DOUBLE-DECLINING-BALANCE DEPRECIATION Cabulation d depeciation expense perunit Cost of machne Less: Estimated resdual vabe Cacuaon of deprecieticn rate Dvide by: Expected useful yeer Divide by: Expected number of unts to be produced Depecetion experse per uri De preciation for the Peiod End of Period Beginn ing-of Period Book Value on for the Period End of Period De preciation Depre ciation Accumulated ExpenseDepre aation De preciaton Depreciaton Accumulated ExpenseDeprecia ion Year Book Value earNumber of Units Per Unit Book Val ue 188.20 S 159200 2017 41 2020 Total Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts