Question: Exercise 9-6 Variable Overhead Variances [LO9-6] Logistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its

![Exercise 9-6 Variable Overhead Variances [LO9-6] Logistics Solutions provides order fulfillment](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e97e6bd9861_28366e97e6b79053.jpg)

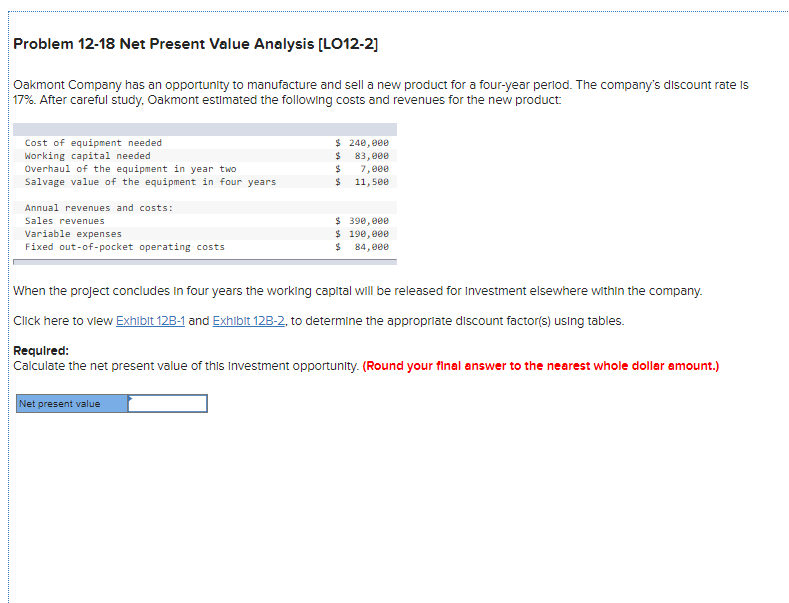

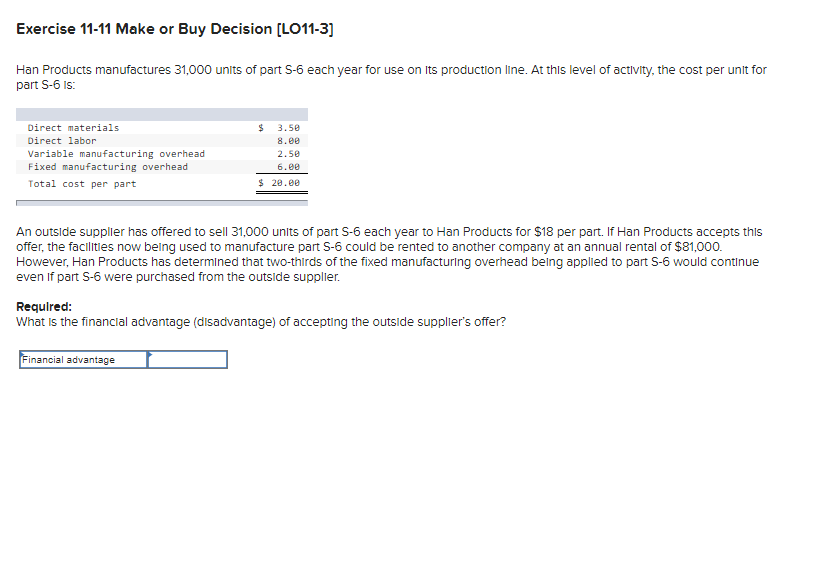

Exercise 9-6 Variable Overhead Variances [LO9-6] Logistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its dot.com clients. When a client recelves an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs It, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor-hours. In the most recent month, 110,000 items were shipped to customers using 3,500 direct labor-hours. The company incurred a total of $9,450 in varlable overhead costs. According to the company's standards, 0.03 direct labor-hours are required to fulfill an order for one item and the variable overhead rate is $275 per direct labor-hour. Required: 1. What is the standard labor-hours allowed (SH) to ship 110,000 items to customers? 2. What is the standard varlable overhead cost allowed (SH SR) to ship 110,000 items to customers? 3. What is the variable overhead spending varlance? 4. What is the variable overhead rate variance and the variable overhead efficiency variance? (For requirements 3 and 4, Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (I.e., zero variance). Input all amounts as positive values. Do not round Intermediate calculations.) 1. Standard quantity of labor-hours allowed 2. Standard variable overhead cost allowed 3. Variable overhead spending variance 4. Variable overhead rate variance Variable overhead efficiency variance U U Problem 12-18 Net Present Value Analysis (LO12-2] Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The company's discount rate is 17%. After careful study, Oakmont estimated the following costs and revenues for the new product Cost of equipment needed Working capital needed Overhaul of the equipment in year two Salvage value of the equipment in four years $ 240, we $ 83, eee $ 7,000 $ 11,500 Annual revenues and costs: Sales revenues Variable expenses Fixed out-of-pocket operating costs $ 390, eee $ 190, eee $ 84, eee When the project concludes in four years the working capital will be released for Investment elsewhere within the company. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: Calculate the net present value of this Investment opportunity. (Round your final answer to the nearest whole dollar amount.) Net present value Exercise 11-11 Make or Buy Decision [LO11-3] Han Products manufactures 31,000 units of part 5-6 each year for use on its production line. At this level of activity, the cost per unit for part S-6 IS: $ Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost per part 3.5e 8.ee 2.se 6.00 $ 20.00 An outside supplier has offered to sell 31,000 units of part S-6 each year to Han Products for $18 per part. If Han Products accepts this offer, the facilities now being used to manufacture part 5-6 could be rented to another company at an annual rental of $81,000. However, Han Products has determined that two-thirds of the fixed manufacturing overhead being applied to part 5-6 would continue even if part 5-6 were purchased from the outside supplier. Required: What is the financial advantage (disadvantage) of accepting the outside supplier's offer? Financial advantage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts