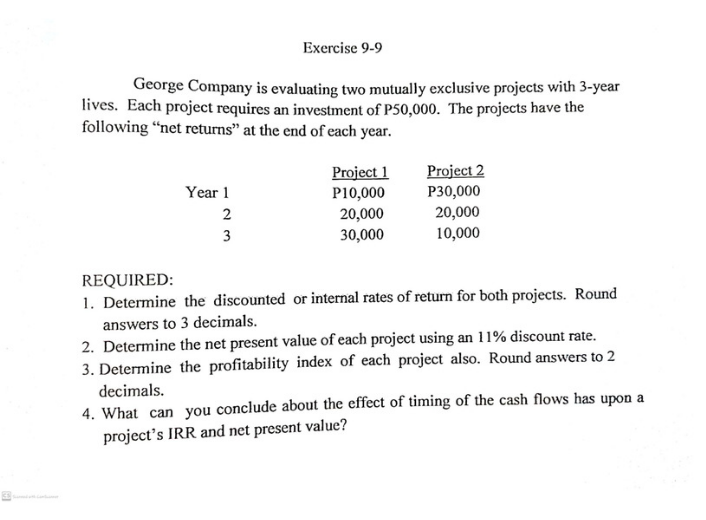

Question: Exercise 9-9 George Company is evaluating two mutually exclusive projects with 3-year lives. Each project requires an investment of P50,000. The projects have the following

Exercise 9-9 George Company is evaluating two mutually exclusive projects with 3-year lives. Each project requires an investment of P50,000. The projects have the following "net returns at the end of each year. Year 1 2 3 Project 1 P10,000 20,000 30,000 Project 2 P30,000 20,000 10,000 REQUIRED: 1. Determine the discounted or internal rates of return for both projects. Round answers to 3 decimals. 2. Determine the net present value of each project using an 11% discount rate. 3. Determine the profitability index of each project also. Round answers to 2 decimals. 4. What can you conclude about the effect of timing of the cash flows has upon a project's IRR and net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts