Question: Exercise A - 8 ( Algo ) Derivatives; cash flow hedge; futures contract; forecasted purchase [ LOA - 2 ] Snackums, Incorporated, purchases wheat for

Exercise AAlgo Derivatives; cash flow hedge; futures contract; forecasted purchase LOA

Snackums, Incorporated, purchases wheat for use in its food manufacturing process. Snackums operates in a highly competitive industry and is rarely able to increase its sales price.

On January Snackums estimates that it only has enough wheat inventory to meet its manufacturing needs for the first half of and forecasts the purchase of bushels of wheat on June from its supplier, Trigo Farms.

Because Snackums is concerned that the price of wheat will increase during the coming months it enters into four June wheat futures contracts on January to purchase wheat.

Each futures contract is based on the purchase of bushels of wheat at $ per bushel on June and will settle in cash at maturity. For purposes of this problem, the daily margin accounts with the clearinghouse are ignored.

The company must report changes in the fair value of its hedging instruments each quarter. The fair value of the futures contract at inception is zero.

Snackums designates the futures contract as a hedge of the variability of cash flows attributed to changes in the spot price of wheat for its forecasted purchase of wheat.

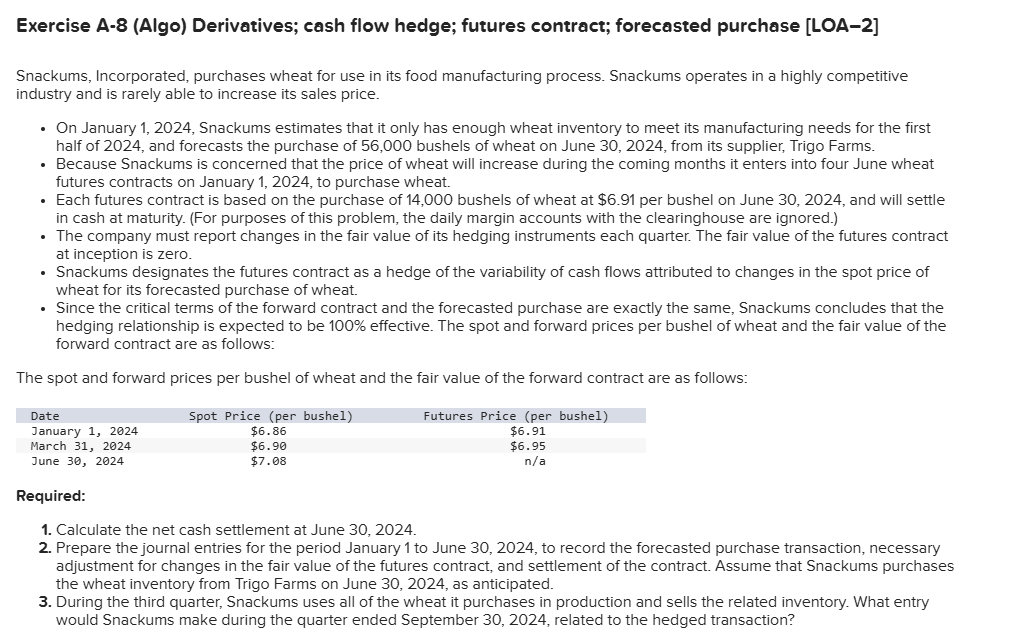

Since the critical terms of the forward contract and the forecasted purchase are exactly the same, Snackums concludes that the hedging relationship is expected to be effective. The spot and forward prices per bushel of wheat and the fair value of the forward contract are as follows:

The spot and forward prices per bushel of wheat and the fair value of the forward contract are as follows:

Required:

Calculate the net cash settlement at June

Prepare the journal entries for the period January to June to record the forecasted purchase transaction, necessary adjustment for changes in the fair value of the futures contract, and settlement of the contract. Assume that Snackums purchases the wheat inventory from Trigo Farms on June as anticipated.

During the third quarter, Snackums uses all of the wheat it purchases in production and sells the related inventory. What entry would Snackums make during the quarter ended September related to the hedged transaction? Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required

During the third quarter, Snackums uses all of the wheat it purchases in production and sells the related inventory. What entry would Snackums make during the quarter ended September related to the hedged transaction?

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock