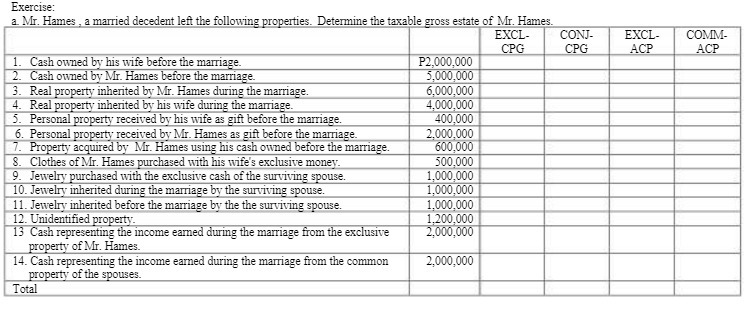

Question: Exercise: a Mr. Hames , a married decedent left the following properties. Determine the taxable gross estate of Mr. Hames. EXCL- CONJ- EXCL- COMM- CPG

Exercise: a Mr. Hames , a married decedent left the following properties. Determine the taxable gross estate of Mr. Hames. EXCL- CONJ- EXCL- COMM- CPG CPG ACP ACP 1. Cash owned by his wife before the marriage. P2,000,000 2. Cash owned by Mr. Hames before the marriage. 5.000.000 3. Real property inherited by Mr. Hames during the marriage. 6.000,000 4. Real property inherited by his wife during the marriage. 4.000.000 5. Personal property received by his wife as gift before the marriage. 400.000 6. Personal property received by Mr. Hames as gift before the marriage. 2.000.000 7. Property acquired by Mr. Hames using his cash owned before the marriage. 600.000 8. Clothes of Mr. Hames purchased with his wife's exclusive money. 500.000 9. Jewelry purchased with the exclusive cash of the surviving spouse. 1,000,000 10. Jewelry inherited during the marriage by the surviving spouse. 1,000,000 11. Jewelry inherited before the marriage by the the surviving spouse. 1.000.000 12. Unidentified property. 1.200.000 13 Cash representing the income earned during the marriage from the exclusive 2.000,000 property of Mr. Hames 14. Cash representing the income earned during the marriage from the common 2.000,000 property of the spouses. Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts