Question: Exercise Albert#1 Albert Corp. Prepares its financial statements under U.S. GAAP During the Year does not hedge this transaction. The spot rate for the Kroner

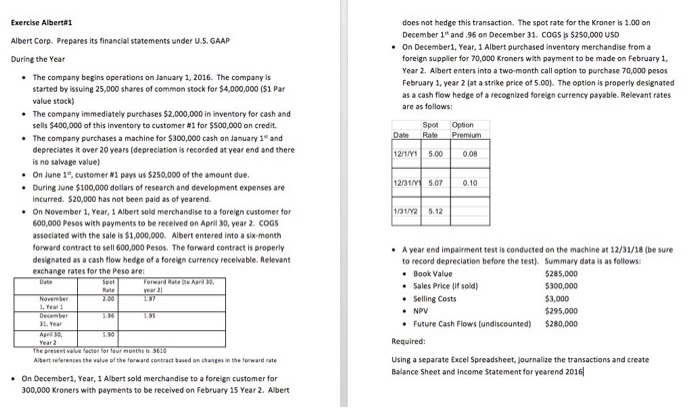

Exercise Albert#1 Albert Corp. Prepares its financial statements under U.S. GAAP During the Year does not hedge this transaction. The spot rate for the Kroner is 1.00 on December 1t and.96 on December 31. COGS is $250,000 USD On December1, Year,1 Albert purchased inventory merchandise from a foreign supplier for 70,000 Kroners with payment to be made on February 1 Year 2. Abert enters into a two-month call option to purchase 70,000 pesos February 1, year 2 (at a strike price of 5.00). The option is properly designated as a cash flow hedge of a recognized foreign currency payable. Relevant rates are as follows: . The company begins operations on January 1, 2016. The company is started by issuing 25,000 shares of common stock for $4,000,000 ($1 Par value stock) The company immediately purchases $2,000,000 in inventory for cash and sells $400,000 of this inventory to customer #1 for $S00.000 on credit. . Spot Option The company purchases a machine for $300,000 cash on January 1 and depreciates it over 20 years (depreciation is recorded at year end and there is no salvage value) On June 1", customer #1 pays us $250,000 of the amount due. During June $100,000 dollars of research and development expenses are incurred. $20,000 has not been paid as of yearend 21Y 5.00 008 * 231M 5.07 0.10 On November 1, Year,1 Albert sold merchandise to a foreign customer for 2 5.12 600,000 Pesos with payments to be received on April 30, year 2. COGS associated with the sale is $1,000,000. Albert entered into a six-month forward contract to sell 600,000 Pesos. The forward contract is properly designated as a cash flow hedge of a forelign currency receivable. Relevant exchange rates for the Peso are .A year end impairment test is conducted on the machine at 12/31/18 (be sure to record depreciation before the test). Summary data is as follows Book Value * Sales Price sold . Selling Costs $285,000 300,000 $3,000 295,000 $280,000 NPV Future Cash Flows (undiscounted) . Required: Using a separate Excel Spreadsheet, journalize the transactions and create Balance Sheet and Income Statement for yearend 2016 Albert teleresces tbe walue o!forward contract based ge, changes in thforward rate On Decemberl, Year, 1 Albert sold merchandise to a foreign customer for 300,000 Kroners with payments to be received on February 15 Year 2, Albe Exercise Albert#1 Albert Corp. Prepares its financial statements under U.S. GAAP During the Year does not hedge this transaction. The spot rate for the Kroner is 1.00 on December 1t and.96 on December 31. COGS is $250,000 USD On December1, Year,1 Albert purchased inventory merchandise from a foreign supplier for 70,000 Kroners with payment to be made on February 1 Year 2. Abert enters into a two-month call option to purchase 70,000 pesos February 1, year 2 (at a strike price of 5.00). The option is properly designated as a cash flow hedge of a recognized foreign currency payable. Relevant rates are as follows: . The company begins operations on January 1, 2016. The company is started by issuing 25,000 shares of common stock for $4,000,000 ($1 Par value stock) The company immediately purchases $2,000,000 in inventory for cash and sells $400,000 of this inventory to customer #1 for $S00.000 on credit. . Spot Option The company purchases a machine for $300,000 cash on January 1 and depreciates it over 20 years (depreciation is recorded at year end and there is no salvage value) On June 1", customer #1 pays us $250,000 of the amount due. During June $100,000 dollars of research and development expenses are incurred. $20,000 has not been paid as of yearend 21Y 5.00 008 * 231M 5.07 0.10 On November 1, Year,1 Albert sold merchandise to a foreign customer for 2 5.12 600,000 Pesos with payments to be received on April 30, year 2. COGS associated with the sale is $1,000,000. Albert entered into a six-month forward contract to sell 600,000 Pesos. The forward contract is properly designated as a cash flow hedge of a forelign currency receivable. Relevant exchange rates for the Peso are .A year end impairment test is conducted on the machine at 12/31/18 (be sure to record depreciation before the test). Summary data is as follows Book Value * Sales Price sold . Selling Costs $285,000 300,000 $3,000 295,000 $280,000 NPV Future Cash Flows (undiscounted) . Required: Using a separate Excel Spreadsheet, journalize the transactions and create Balance Sheet and Income Statement for yearend 2016 Albert teleresces tbe walue o!forward contract based ge, changes in thforward rate On Decemberl, Year, 1 Albert sold merchandise to a foreign customer for 300,000 Kroners with payments to be received on February 15 Year 2, Albe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts