Question: Exercise based on chapter IRRECOVERABLE DEBTS & ALLOWANCE FOR DOUBTFUL DEBTS The following data relates to Stelios: a. Balance of Trade Receivables at 31 December

Exercise based on chapter IRRECOVERABLE DEBTS & ALLOWANCE FOR DOUBTFUL DEBTS

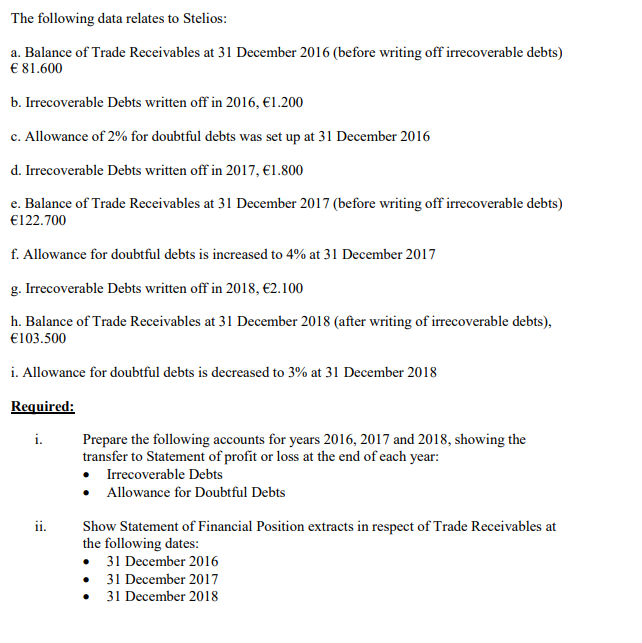

The following data relates to Stelios: a. Balance of Trade Receivables at 31 December 2016 (before writing off irrecoverable debts) 81.600 b. Irrecoverable Debts written off in 2016, 1.200 c. Allowance of 2% for doubtful debts was set up at 31 December 2016 d. Irrecoverable Debts written off in 2017, 1.800 e. Balance of Trade Receivables at 31 December 2017 (before writing off irrecoverable debts) 122.700 f. Allowance for doubtful debts is increased to 4% at 31 December 2017 g. Irrecoverable Debts written off in 2018, 2.100 h. Balance of Trade Receivables at 31 December 2018 (after writing of irrecoverable debts), 103.500 i. Allowance for doubtful debts is decreased to 3% at 31 December 2018 Required: i. Prepare the following accounts for years 2016, 2017 and 2018, showing the transfer to Statement of profit or loss at the end of each year: Irrecoverable Debts Allowance for Doubtful Debts ii. Show Statement of Financial Position extracts in respect of Trade Receivables at the following dates: 31 December 2016 31 December 2017 31 December 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts