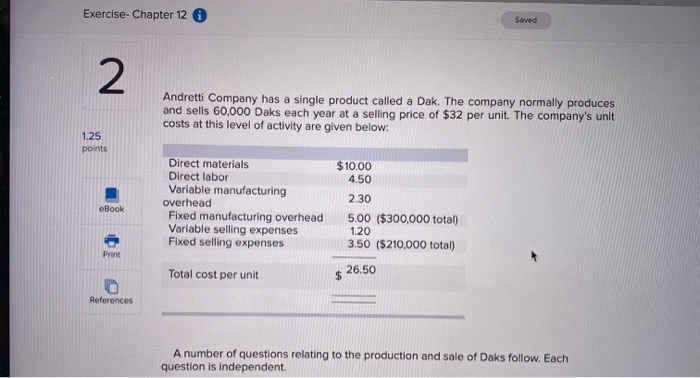

Question: Exercise- Chapter 12 Andretti Company has a single product called a Dak. The company normally produces and sells 60,000 Daks each year at a selling

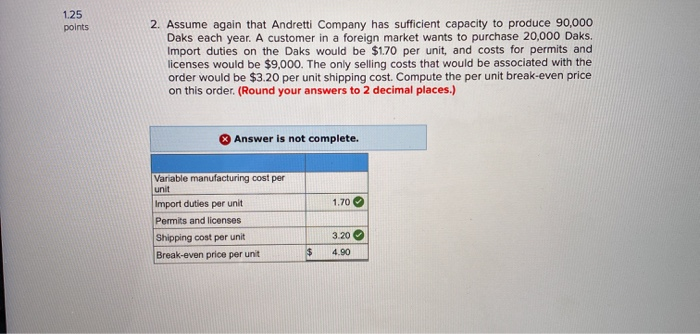

Exercise- Chapter 12 Andretti Company has a single product called a Dak. The company normally produces and sells 60,000 Daks each year at a selling price of $32 per unit. The company's unit costs at this level of activity are given below: 1.25 points Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses eBook $10.00 4.50 2.30 5.00 ($300,000 total) 1.20 3.50 ($210,000 total) Print Total cost per unit $26.50 References A number of questions relating to the production and sale of Daks follow. Each question is independent. 1.25 points 2. Assume again that Andretti Company has sufficient capacity to produce 90,000 Daks each year. A customer in a foreign market wants to purchase 20,000 Daks, Import duties on the Daks would be $1.70 per unit, and costs for permits and licenses would be $9,000. The only selling costs that would be associated with the order would be $3.20 per unit shipping cost. Compute the per unit break-even price on this order. (Round your answers to 2 decimal places.) Answer is not complete. Variable manufacturing cost per unit 1.70 Import duties per unit Permits and licenses Shipping cost per unit Break-even price per unit 320 4.90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts