Question: Exercise D-6 Journalizing partnership transactions LO P2 On March 1, 2015, Eckert and Kelley formed a partnership.Eckert contributed $94,000 cash and Kelley contributed land valued

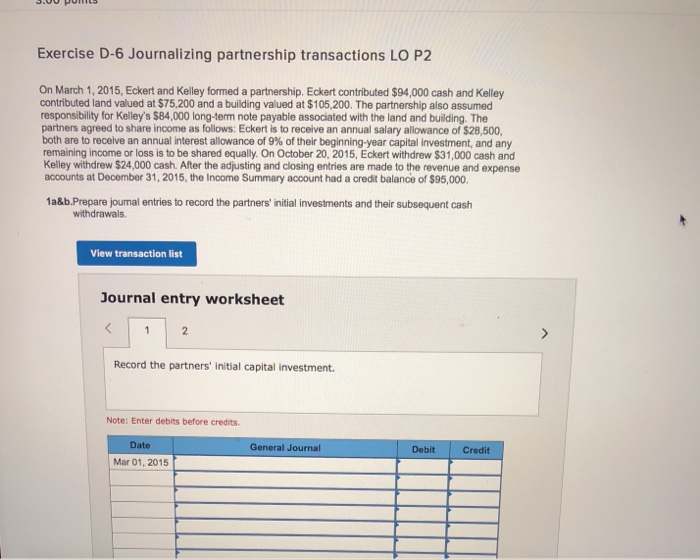

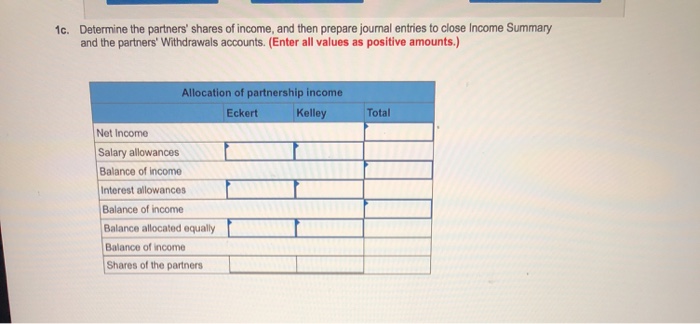

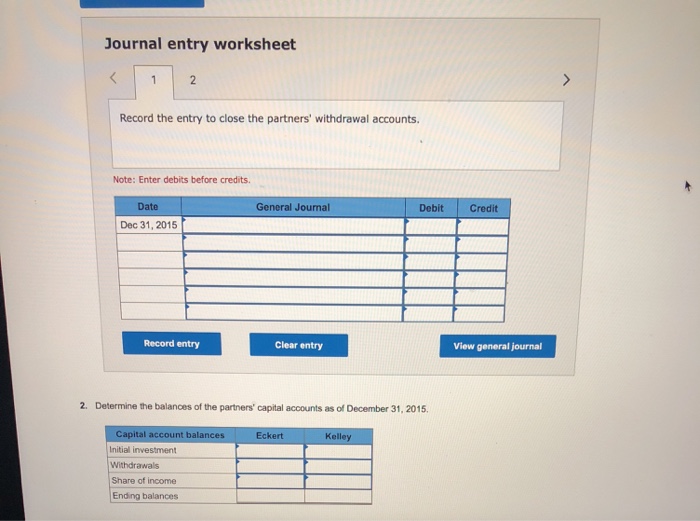

Exercise D-6 Journalizing partnership transactions LO P2 On March 1, 2015, Eckert and Kelley formed a partnership.Eckert contributed $94,000 cash and Kelley contributed land valued at $75,200 and a building valued at $105,200. The partnership also assumed responsibility for Kelley's $84,000 long-term note payable associated with the land and building. The partners agreed to share income as follows: Eckert is to receive an annual salary allowance of $28,500, both are to receive an annual interest allowance of 9% of their beginning-year capital investment, and any remaining income or loss is to be shared equally. On October 20, 2015, Eckert withdrew $31,000 cash and Kelley withdrew $24,000 cash. After the adjusting and closing entries are made to the revenue and expense accounts at December 31, 2015, the Income Summary account had a credit balance of $95,000 1a&b.Prepare jounal entries to record the partners' initial investments and their subsequent cash withdrawals. View transaction list Journal entry worksheet Record the partners' initial capital investment Note: Enter debits before credits. Date General Journal Debit Credit Mar 01, 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts