Question: Exercise DS-26 Will Benjamin has been working on Swifty Paints' cash budget for the coming year. Based on his projections for March, the beginning cash

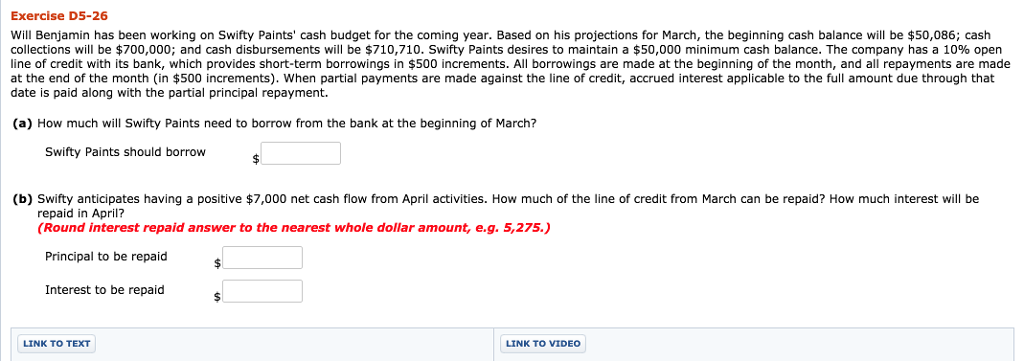

Exercise DS-26 Will Benjamin has been working on Swifty Paints' cash budget for the coming year. Based on his projections for March, the beginning cash balance will be $50,086; cash collections will be $700,000; and cash disbursements will be $710,710. Swifty Paints desires to maintain a $50,000 minimum cash balance. The company has a 10% open line of credit with its bank, which provides short-term borrowings in $500 increments. All borrowings are made at the beginning of the month, and all repayments are made at the end of the month (in $500 increments). When partial payments are made against the line of credit, accrued interest applicable to the full amount due through that date is paid along with the partial principal repayment. (a) How much will Swifty Paints need to borrow from the bank at the beginning of March? Swifty Paints should borrow (b Swifty anticipates having a positive $7,000 net cash flow from April activities repaid in April? (Round interest repaid answer to the nearest whole dollar amount, e.g. 5,275.) o much of the line of credit from March can be repaid?How much interest wil be Principal to be repaid Interest to be repaid LINK TO TEXT LINK TO VIDEO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts