Question: Exercise H-2 Your answer is partially correct. Try again. Crane Company had these transactions pertaining to stock investments: Feb. 1 Purchased 1,138 shares of BJ

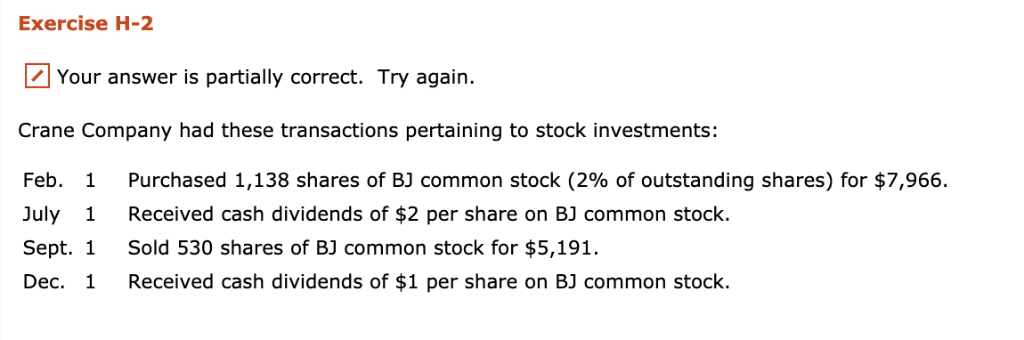

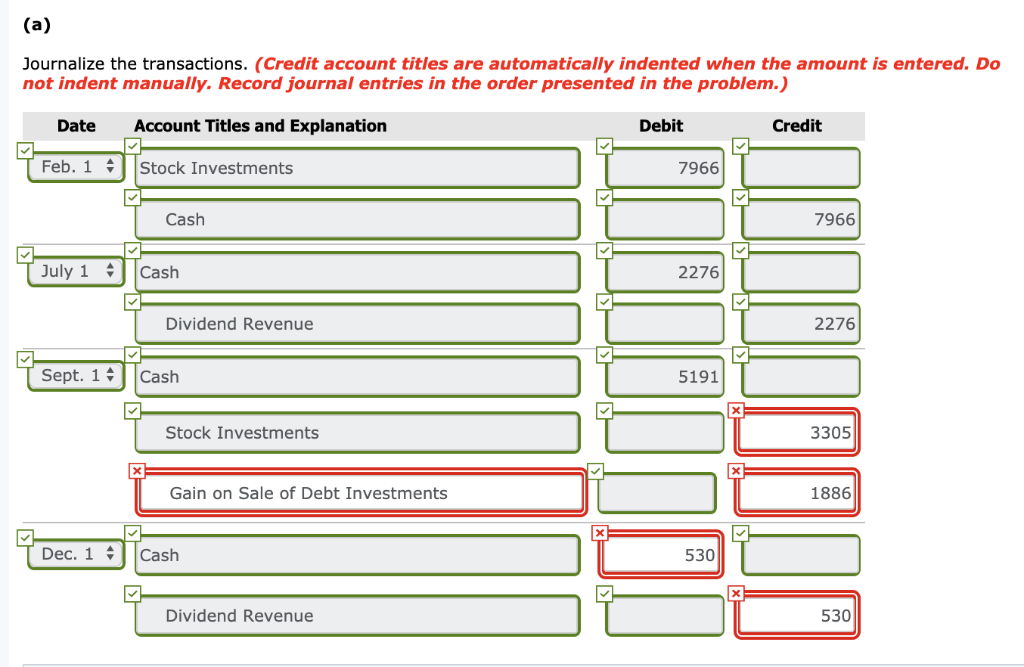

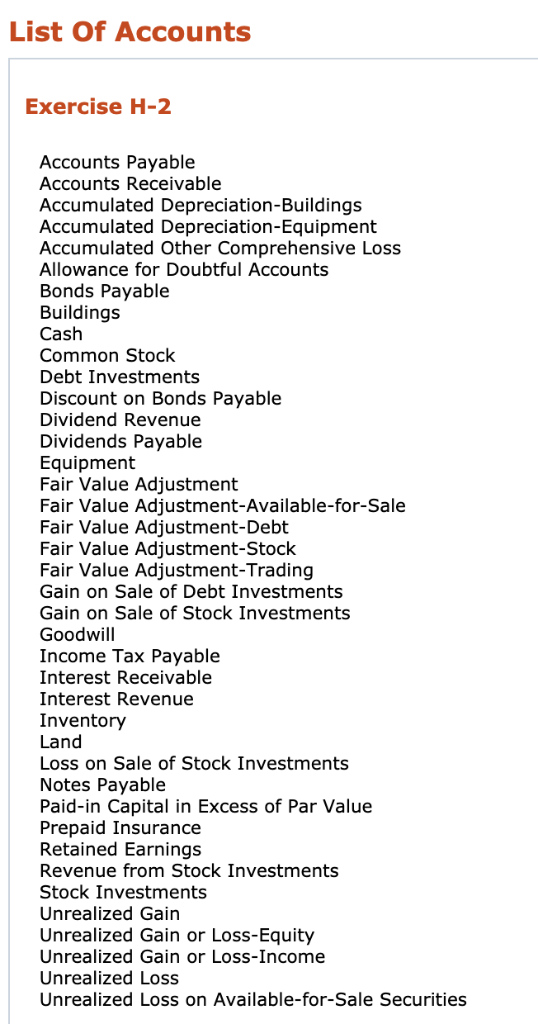

Exercise H-2 Your answer is partially correct. Try again. Crane Company had these transactions pertaining to stock investments: Feb. 1 Purchased 1,138 shares of BJ common stock (2% of outstanding shares) for $7,966. July 1 Received cash dividends of $2 per share on BJ common stock. Sept. 1 Sold 530 shares of BJ common stock for $5,191. Dec. 1 Received cash dividends of $1 per share on BJ common stock. Journalize the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Feb. 1 Stock Investments 7966 Cash 7966 July 1Cash 2276 Dividend Revenue 2276 5191 Sept. 1 | | Cash Stock Investments 3305 Gain on Sale of Debt Investments 1886 Dec. 1Cash 530 Dividend Revenue 530 List Of Accounts Exercise H-2 Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accumulated Other Comprehensive Loss Allowance for Doubtful Accounts Bonds Payable Buildings Cash Common Stock Debt Investments Discount on Bonds Payable Dividend Revenue Dividends Payable Equipment Fair Value Adjustment Fair Value Adjustment-Available-for-Sale Fair Value Adjustment-Debt Fair Value Adjustment-Stock Fair Value Adjustment-Trading Gain on Sale of Debt Investments Gain on Sale of Stock Investments Goodwill Income Tax Payable Interest Receivable Interest Revenue Inventory Land Loss on Sale of Stock Investments Notes Payable Paid-in Capital in Excess of Par Value Prepaid Insurance Retained Earnings Revenue from Stock Investments Stock Investments Unrealized Gain Unrealized Gain or Loss-Equity Unrealized Gain or Loss-Income Unrealized Loss Unrealized Loss on Available-for-Sale Securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts