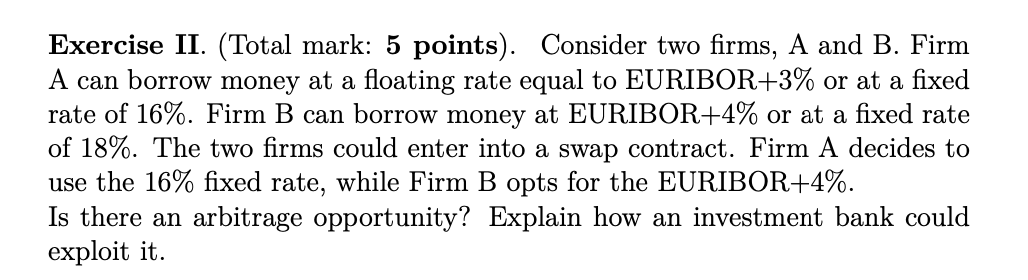

Question: Exercise II . ( Total mark: 5 points ) . Consider two firms, A and B . Firm A can borrow money at a floating

Exercise IITotal mark: points Consider two firms, A and B Firm A can borrow money at a floating rate equal to EURIBOR or at a fixed rate of Firm B can borrow money at EURIBOR or at a fixed rate of The two firms could enter into a swap contract. Firm A decides to use the fixed rate, while Firm B opts for the EURIBOR

Is there an arbitrage opportunity? Explain how an investment bank could exploit it

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock