Question: EXERCISE ONE ESTIMATE BASED ON SALES 1) June 30: A business records $750,000 in credit sales for the month of June. In the past, approximately

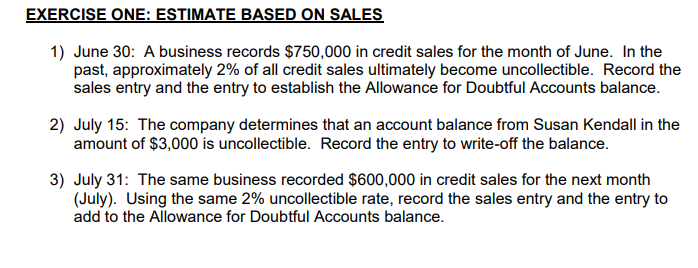

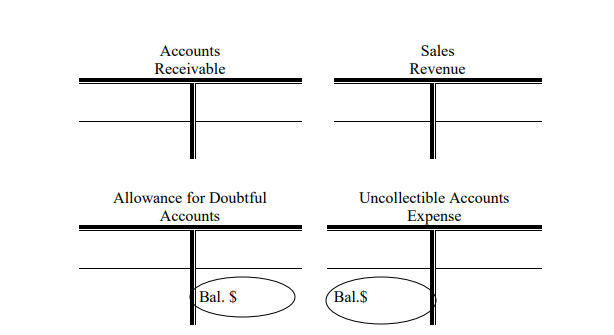

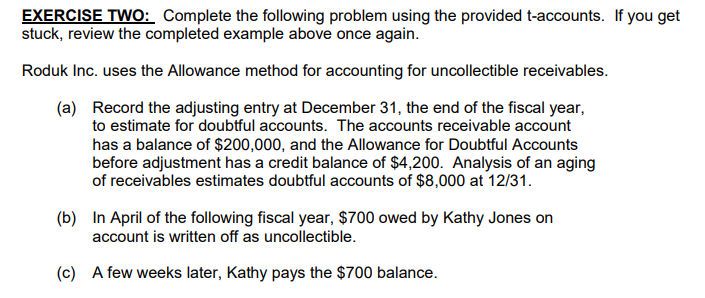

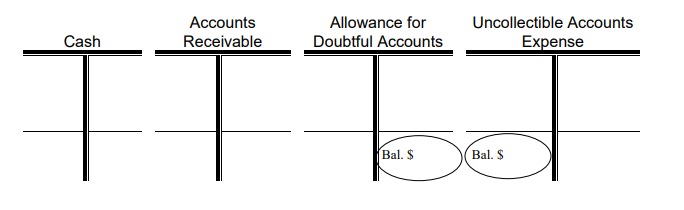

EXERCISE ONE ESTIMATE BASED ON SALES 1) June 30: A business records $750,000 in credit sales for the month of June. In the past, approximately 2% of all credit sales ultimately become uncollectible. Record the sales entry and the entry to establish the Allowance for Doubtful Accounts balance. amount of $3,000 is uncollectible. Record the entry to write-off the balance. (July). Using the same 2% uncollectible rate, record the sales entry and the entry to 2) July 15: The company determines that an account balance from Susan Kendall in the 3) July 31: The same business recorded $600,000 in credit sales for the next month add to the Allowance for Doubtful Accounts balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts