Question: Exercise Problem 2 Compatibility Mode] - Word (Product Activation Failed) MAILINGS REVIEW VIEW PAGE LAYOUT REFERENCES 3 PAAEET XX A. A AaBoCcDc AaBbcc AaBbcc AaBbcdi

![Exercise Problem 2 Compatibility Mode] - Word (Product Activation Failed) MAILINGS](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6714173a5a864_91367141739d3a4b.jpg)

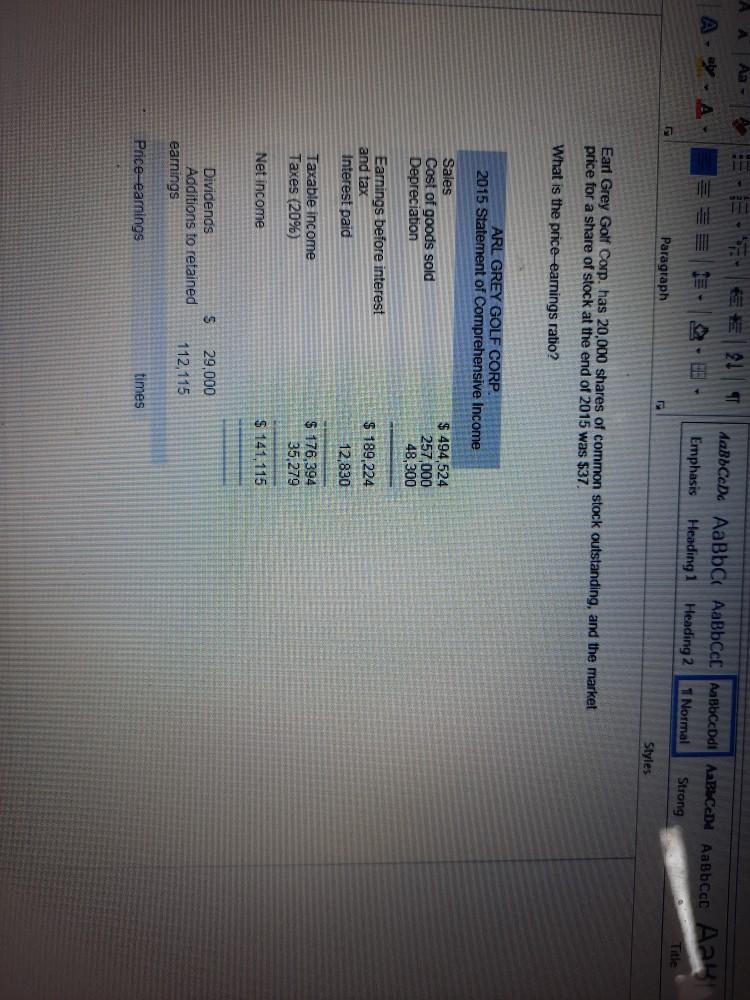

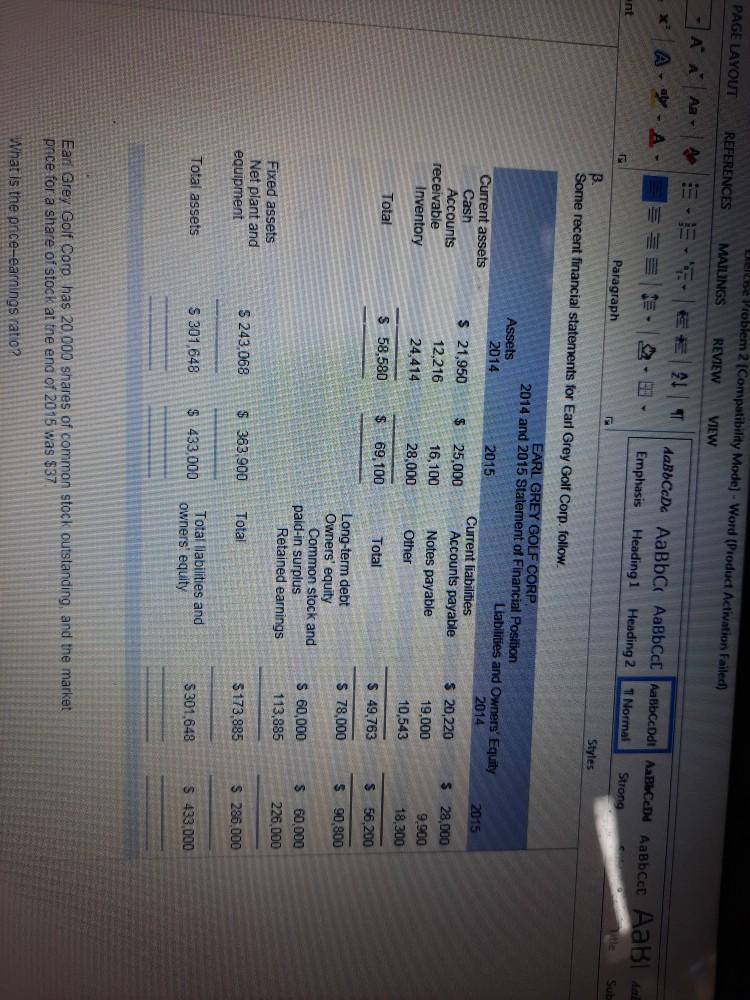

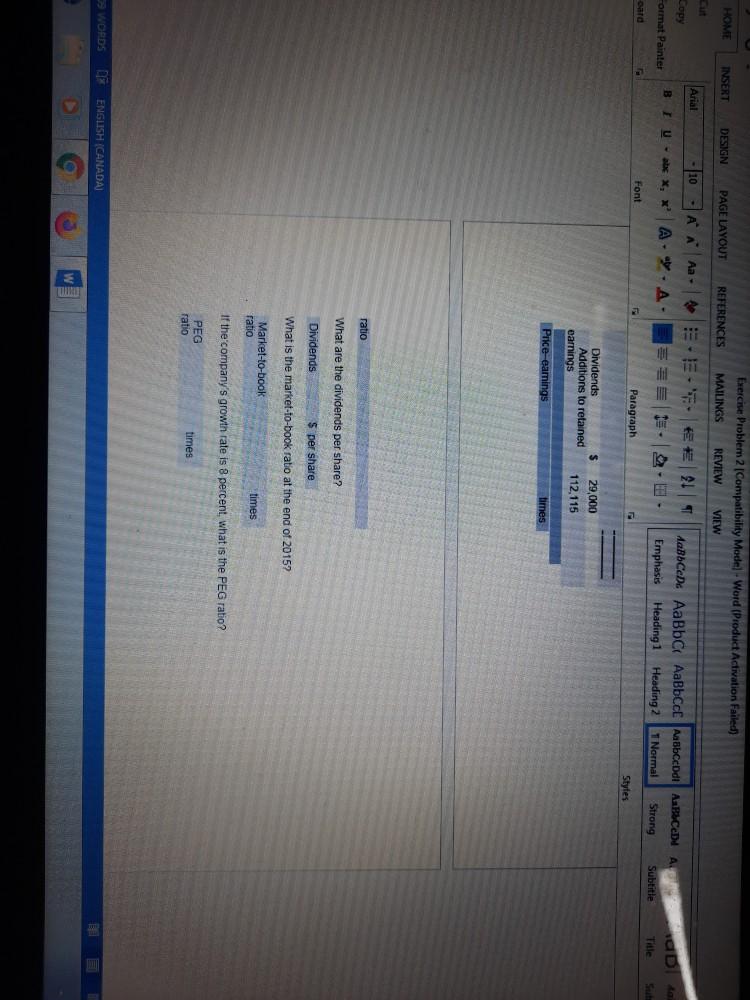

Exercise Problem 2 Compatibility Mode] - Word (Product Activation Failed) MAILINGS REVIEW VIEW PAGE LAYOUT REFERENCES 3 PAAEET XX A. A AaBoCcDc AaBbcc AaBbcc AaBbcdi ABCD AaBbcc Emphasis Heading 1 Heading 2 1 Normal Strong Subtitle FEL Tit Font Paragraph 5 Styles Ratio Analysis Problems 1 Gunton Corp. has net income of $179,000, a profit margin of 8.30 percent, and an accounts receivable balance of $118,370. Assuming 70 percent of sales are on credit, what are the Gunton's days' sales in receivables? Days' sales in receivables days 2. 2 Manitou Corp. had additions to retained earnings for the year just ended of $298,000. The firm paid out $178,000 in cash dividends, and it has ending total equity of $5.33 million. The company currently has 140,000 shares of common stock outstanding What are the earnings per share? Earnings $ per share What are the dividends per share? Dividends $ per share What is the book value per share? Book value $ per share If the stock currently sells for $70 per share what is the market-to-book ratio? Market-to-book ratio times What is the pnce-earnings ratio? Price-earnings ratic times If the company had sales of $4 27 million what is the price-sales ratio? Price-sales ratio times A A E E 21 . Aaby. A SE DE Emphasis Heading 1 Heading 2 1 Normal Strong Paragraph Styles Earl Grey Golf Corp. has 20,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2015 was $37. What is the price earnings ratio? ARL GREY GOLF CORP. 2015 Statement of Comprehensive Income Sales Cost of goods sold Depreciation $ 494,524 257,000 48,300 Earnings before interest and tax Interest paid $ 189,224 12,830 Taxable income Taxes (20%) $ 176,394 35,279 Net income $ 141,115 5 29,000 Dividends Additions to retained earnings 112,115 Price-earings times Lielbe Problem 2 (Compatibility Mode] - Word (Product Activation Failed) PAGE LAYOUT REFERENCES MAILINGS REVIEW VIEW A A A A SEE #21 T . | A---A- Emphasis Heading 1 Heading 2 1 Normal Strong Sub ant Paragraph B. Styles Some recent financial statements for Earl Grey Golf Corp. follow. EARL GREY GOLF CORP. 2014 and 2015 Statement of Financial Position Assets Liabilities and Owners Equity 2014 2015 Current assets 2014 Current liabilities Cash $ 21,950 $ 25,000 Accounts payable Accounts $ 20,220 receivable 12,216 16,100 Notes payable 19,000 Inventory 24,414 28,000 Other 10,543 2015 $ 28,000 9.900 18,300 Total $ 58,580 $ 69,100 Total $ 49,763 $ 56,200 S 78,000 $ 90,800 Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings S 60,000 113,885 $ 60,000 226.000 Fixed assets Net plant and equipment S 243.068 $363.900 Total 5173,885 S 286,000 Total assets S 301,648 $ 433,000 Total liabilities and owners' equity S301,648 $ 433,000 Earl Grey Golf Coro has 20,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2015 was $37 What is the pnce-earnings ratio? HOME INSERT DESIGN Exercise Problem 2 Compatibility Model - Word (Product Activation Failed) MAILINGS REVIEW VIEW PAGE LAYOUT REFERENCES Arial 10 AA Aa- 21 Copy Format Painter BIU-s x, X A.A. AaBbCeDo AaBbc AaBbccc AabbCeDdl ABCD Emphasis Heading 1 Heading 2 I Normal Strong Subtitle cata Font Paragraph Stytes s Dividends Additions to retained 29,000 112,115 earnings Price eamings times ratio What are the dividends per share? Dividends$ per share What is the market-to-book ratio at the end of 2015? Market-to-book ratio times If the company's growth rate is 8 percent, what is the PEG ratio? PEG ratio times WORDS DE ENGLISH (CANADA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts