Question: exercise problems questions 1 and 8 Exercises/Problems 1. (Short-Term Financial Planning) The Itsar Products Company has made the following monthly estimates of cash receipts and

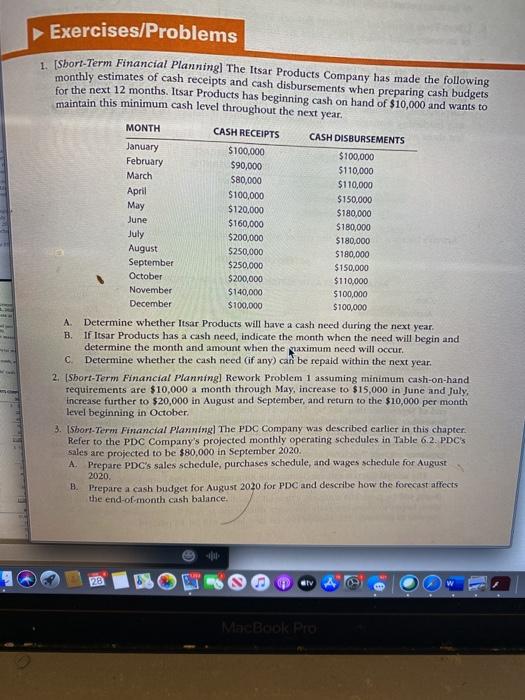

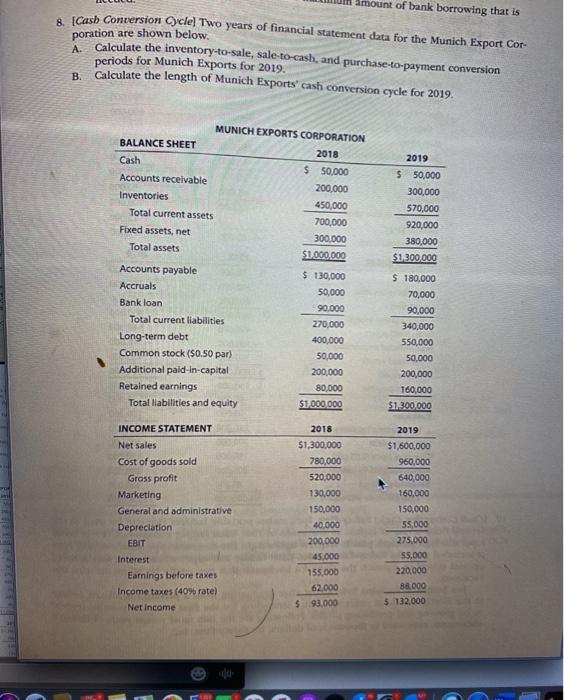

Exercises/Problems 1. (Short-Term Financial Planning) The Itsar Products Company has made the following monthly estimates of cash receipts and cash disbursements when preparing cash budgets for the next 12 months. Itsar Products has beginning cash on hand of $10,000 and wants to maintain this minimum cash level throughout the next year. MONTH CASH RECEIPTS CASH DISBURSEMENTS January $100,000 $100,000 February $90,000 $110,000 March $80,000 $110,000 April $100,000 $150,000 May $120,000 $180,000 June $160,000 $180,000 July $200,000 $180,000 August $250,000 $180,000 September $250,000 $150,000 October $200,000 $110,000 November $140,000 $100,000 December $100,000 $100,000 A Determine whether Itsar Products will have a cash need during the next year. B. If Itsar Products has a cash need, indicate the month when the need will begin and determine the month and amount when the guximum need will occur. c Determine whether the cash need (if any) can be repaid within the next year. 2. (Short-Term Financial Planning) Rework Problem 1 assuming minimum cash-on-hand requirements are $10,000 a month through May, increase to $15.000 in June and July, increase further to $20,000 in August and September, and return to the $10,000 per month level beginning in October 3. Short-Term Financial Planning) The PDC Company was described earlier in this chapter. Refer to the PDC Company's projected monthly operating schedules in Table 6.2. PDC'S sales are projected to be $80,000 in September 2020. A. Prepare PDC's sales schedule, purchases schedule, and wages schedule for August 2020 B. Prepare a cash budget for August 2020 for PDC and describe how the forecast affects the end-of-month cash balance. 28 MacBook Pro amount of bank borrowing that is 8. [Cash Conversion Cyciel Two years of financial statement data for the Munich Export Cor- Calculate the inventory-to-sale, sale-to-cash, and purchase-to-payment conversion periods for Munich Exports for 2019. B. Calculate the length of Munich Exports' cash conversion cycle for 2019. poration are shown below. A. MUNICH EXPORTS CORPORATION BALANCE SHEET 2018 Cash $ 50,000 Accounts receivable 200,000 Inventories 450,000 Total current assets 700,000 Fixed assets, net 300,000 Total assets $1.000.000 2019 $ 50,000 300,000 570,000 920,000 380,000 $1,300,000 Accounts payable Accruals Bank loan Total current liabilities Long-term debt Common stock (50.50 par) Additional pald-in-capital Retained earnings Total liabilities and equity $ 130,000 50,000 90.000 270.000 400,000 50,000 200,000 80,000 $1.000.000 $ 180,000 70,000 90,000 340,000 550,000 50,000 200,000 160,000 $1.300.000 2018 $1,300,000 780,000 520,000 130.000 2019 $1,600,000 960,000 INCOME STATEMENT Net sales Cost of goods sold Gross profit Marketing General and administrative Depreciation EBIT Interest Earnings before taxes Income taxes (40% rate) Net Income 150,000 40.000 200.000 45,000 155.000 62.000 $ 93.000 640,000 160,000 150,000 55,000 275.000 $5,000 220,000 88.000 $ 132,000 Exercises/Problems 1. (Short-Term Financial Planning) The Itsar Products Company has made the following monthly estimates of cash receipts and cash disbursements when preparing cash budgets for the next 12 months. Itsar Products has beginning cash on hand of $10,000 and wants to maintain this minimum cash level throughout the next year. MONTH CASH RECEIPTS CASH DISBURSEMENTS January $100,000 $100,000 February $90,000 $110,000 March $80,000 $110,000 April $100,000 $150,000 May $120,000 $180,000 June $160,000 $180,000 July $200,000 $180,000 August $250,000 $180,000 September $250,000 $150,000 October $200,000 $110,000 November $140,000 $100,000 December $100,000 $100,000 A Determine whether Itsar Products will have a cash need during the next year. B. If Itsar Products has a cash need, indicate the month when the need will begin and determine the month and amount when the guximum need will occur. c Determine whether the cash need (if any) can be repaid within the next year. 2. (Short-Term Financial Planning) Rework Problem 1 assuming minimum cash-on-hand requirements are $10,000 a month through May, increase to $15.000 in June and July, increase further to $20,000 in August and September, and return to the $10,000 per month level beginning in October 3. Short-Term Financial Planning) The PDC Company was described earlier in this chapter. Refer to the PDC Company's projected monthly operating schedules in Table 6.2. PDC'S sales are projected to be $80,000 in September 2020. A. Prepare PDC's sales schedule, purchases schedule, and wages schedule for August 2020 B. Prepare a cash budget for August 2020 for PDC and describe how the forecast affects the end-of-month cash balance. 28 MacBook Pro amount of bank borrowing that is 8. [Cash Conversion Cyciel Two years of financial statement data for the Munich Export Cor- Calculate the inventory-to-sale, sale-to-cash, and purchase-to-payment conversion periods for Munich Exports for 2019. B. Calculate the length of Munich Exports' cash conversion cycle for 2019. poration are shown below. A. MUNICH EXPORTS CORPORATION BALANCE SHEET 2018 Cash $ 50,000 Accounts receivable 200,000 Inventories 450,000 Total current assets 700,000 Fixed assets, net 300,000 Total assets $1.000.000 2019 $ 50,000 300,000 570,000 920,000 380,000 $1,300,000 Accounts payable Accruals Bank loan Total current liabilities Long-term debt Common stock (50.50 par) Additional pald-in-capital Retained earnings Total liabilities and equity $ 130,000 50,000 90.000 270.000 400,000 50,000 200,000 80,000 $1.000.000 $ 180,000 70,000 90,000 340,000 550,000 50,000 200,000 160,000 $1.300.000 2018 $1,300,000 780,000 520,000 130.000 2019 $1,600,000 960,000 INCOME STATEMENT Net sales Cost of goods sold Gross profit Marketing General and administrative Depreciation EBIT Interest Earnings before taxes Income taxes (40% rate) Net Income 150,000 40.000 200.000 45,000 155.000 62.000 $ 93.000 640,000 160,000 150,000 55,000 275.000 $5,000 220,000 88.000 $ 132,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts