Question: Exercise translated into English Initial exercise in French Note: Please sometimes you give me answers that are wrong. thank you for giving me good answers

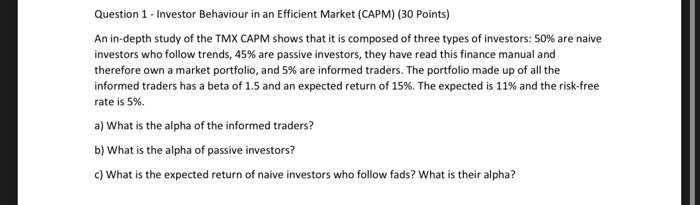

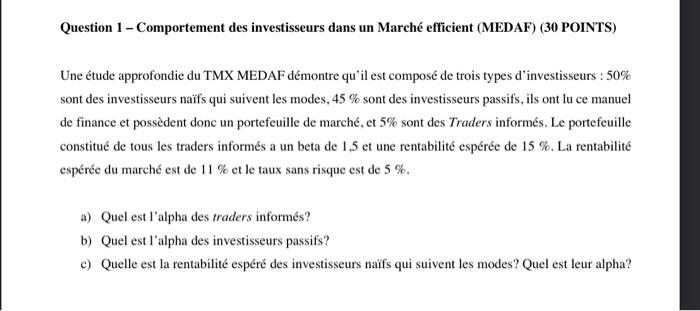

Question 1 - Investor Behaviour in an Efficient Market (CAPM) (30 Points) An in-depth study of the TMX CAPM shows that it is composed of three types of investors: 50% are naive investors who follow trends, 45% are passive investors, they have read this finance manual and therefore own a market portfolio, and 5% are informed traders. The portfolio made up of all the informed traders has a beta of 1.5 and an expected return of 15%. The expected is 11% and the risk-free rate is 5%. a) What is the alpha of the informed traders? b) What is the alpha of passive investors? c) What is the expected return of naive investors who follow fads? What is their alpha? Question 1 - Comportement des investisseurs dans un March efficient (MEDAF) (30 POINTS) Une tude approfondie du TMX MEDAF dmontre qu'il est compos de trois types d'investisseurs : 50% sont des investisseurs nafs qui suivent les modes, 45% sont des investisseurs passifs, ils ont lu ce manuel de finance et possdent donc un portefeuille de march, et 5% sont des Traders informs. Le portefeuille constitu de tous les traders informs a un beta de 1,5 et une rentabilit espre de 15%. La rentabilit espre du march est de 11% et le taux sans risque est de 5%. a) Quel est l'alpha des traders informs? b) Quel est l'alpha des investisseurs passifs? c) Quelle est la rentabilit espr des investisseurs naifs qui suivent les modes? Quel est leur alpha

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts