Question: EXERCISE TWO: BANK RECONCILIATION a) After completing Exercise TWO, what is the correct Adjusted balance per the Books? See circle on the printed exercise. Note:

EXERCISE TWO: BANK RECONCILIATION

a) After completing Exercise TWO, what is the correct Adjusted balance per the Books? See circle on the printed exercise. Note: This adjusted balance should match the Adjusted Balance per the Bank.

b) Does it make sense for the same person who prepares the daily cash deposits for the company to also perform the monthly bank reconciliation (in your answer, be sure to name any specific internal control procedures that may be applicable)?

c) Describe the different types of audit opinions.

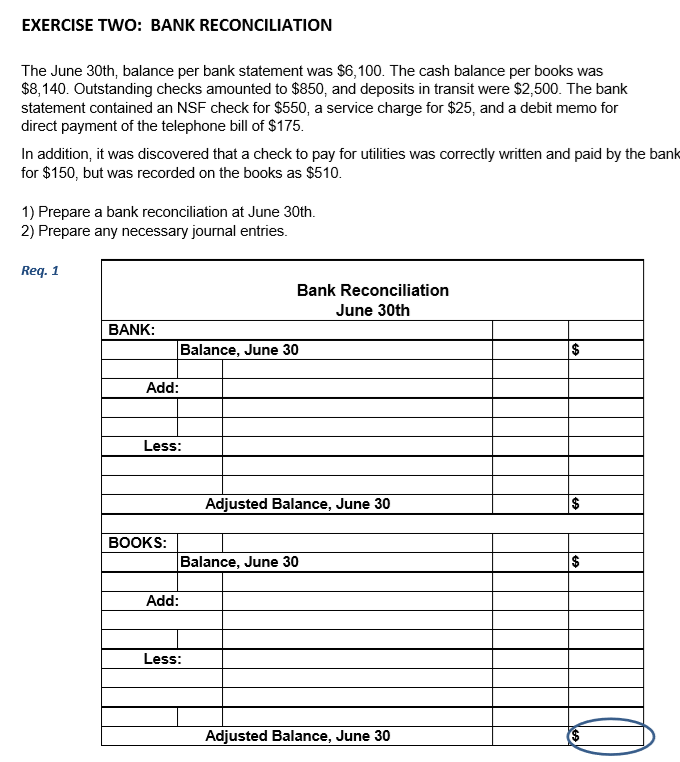

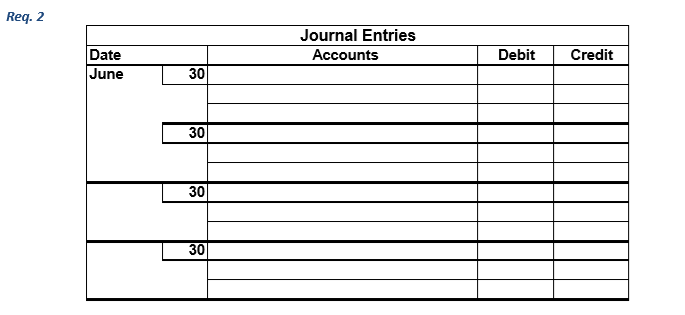

EXERCISE TWO: BANK RECONCILIATION The June 30th, balance per bank statement was $6,100. The cash balance per books was $8,140. Outstanding checks amounted to $850, and deposits in transit were $2,500. The bank statement contained an NSF check for $550, a service charge for $25, and a debit memo for direct payment of the telephone bill of $175. In addition, it was discovered that a check to pay for utilities was correctly written and paid by the bank for $150, but was recorded on the books as $510. 1) Prepare a bank reconciliation at June 30th. 2) Prepare any necessary journal entries Req. 1 Bank Reconciliation June 30th BANK: Balance, June 30 Add Less: Adjusted Balance, June 30 BOOKS: Balance, June 30 Add: Less: Adjusted Balance, June 30 Req. 2 Journal Entries Credit Date June Accounts Debit 30 30 30 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts