Question: Exercise_2_MCQ_OH_ABC_ACMC_student.pdf.pdf - Adobe Acrobat Reader DC O X File Edit View Window Help Home Tools Exercise_2_MCQ_O... x (? Sign In T 4 /5 do Share

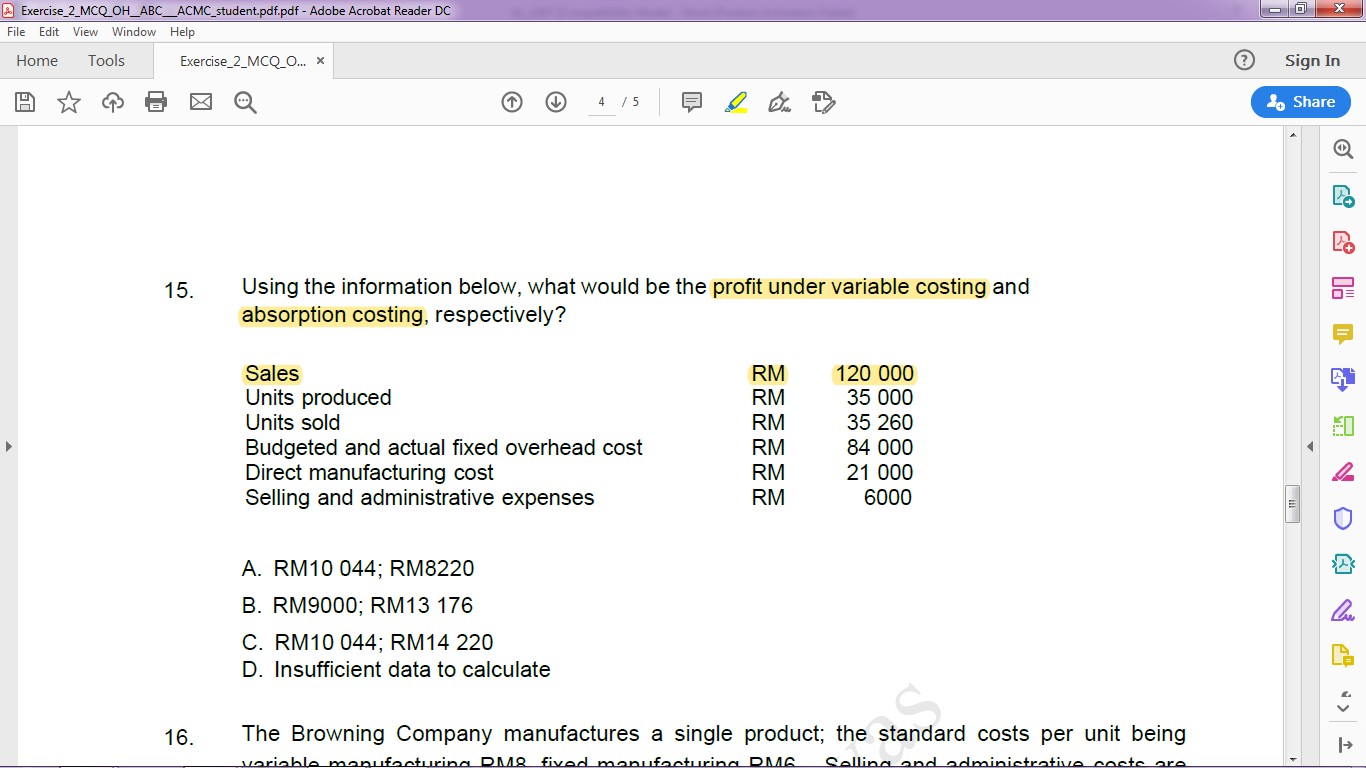

Exercise_2_MCQ_OH_ABC_ACMC_student.pdf.pdf - Adobe Acrobat Reader DC O X File Edit View Window Help Home Tools Exercise_2_MCQ_O... x (? Sign In T 4 /5 do Share 15. Using the information below, what would be the profit under variable costing and absorption costing, respectively? Sales RM 120 000 Units produced RM 35 000 Units sold RM 35 260 Budgeted and actual fixed overhead cost RM 84 000 Direct manufacturing cost RM 21 000 Selling and administrative expenses RM 6000 111 U A. RM10 044; RM8220 B. RM9000; RM13 176 C. RM10 044; RM14 220 Pa D. Insufficient data to calculate 16. The Browning Company manufactures a single product; the standard costs per unit being DMg five DMG Calling

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts