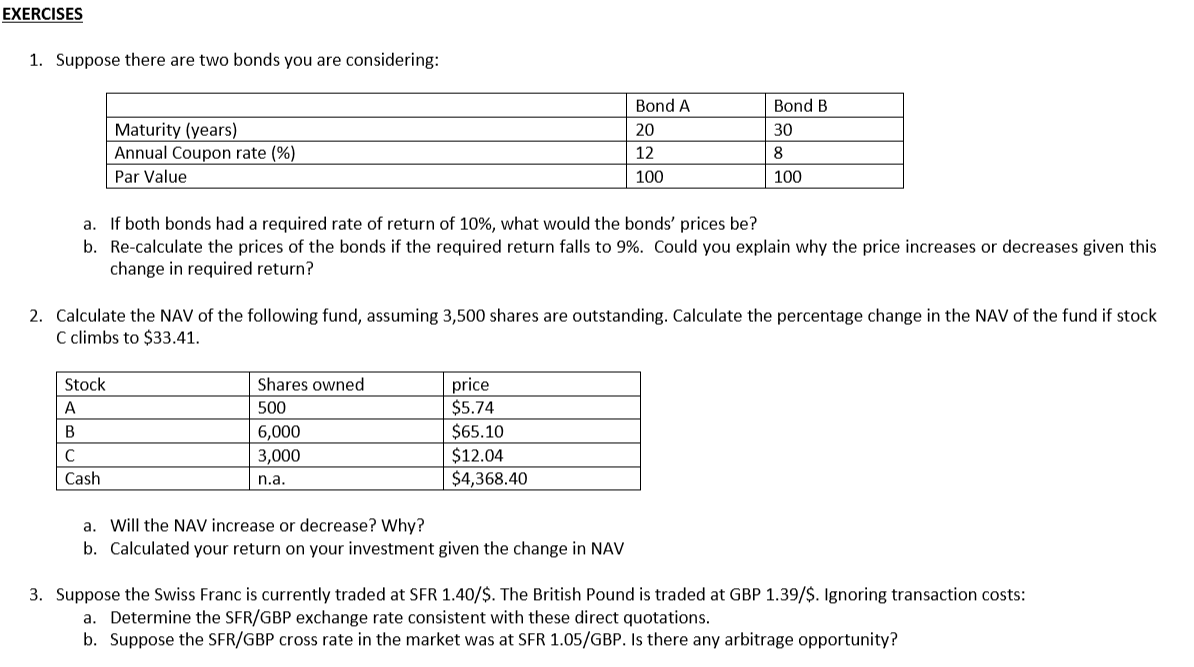

Question: EXERCISES 1. Suppose there are two bonds you are considering: Bond B 30 Maturity (years) Annual Coupon rate (%) Par Value Bond A 20 |

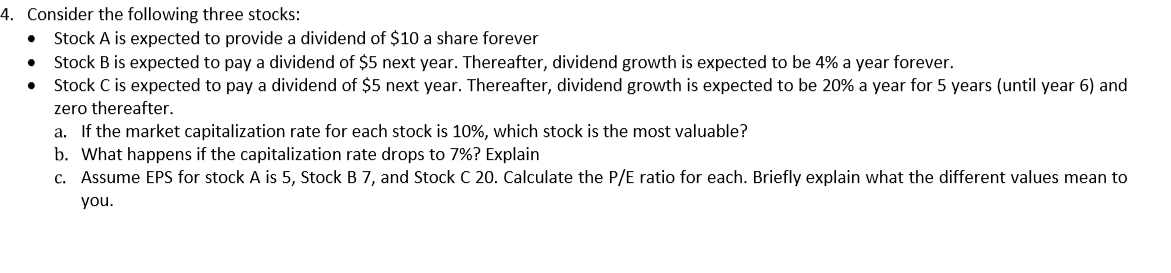

EXERCISES 1. Suppose there are two bonds you are considering: Bond B 30 Maturity (years) Annual Coupon rate (%) Par Value Bond A 20 | 128 100 100 a. If both bonds had a required rate of return of 10%, what would the bonds' prices be? b. Re-calculate the prices of the bonds if the required return falls to 9%. Could you explain why the price increases or decreases given this change in required return? 2. Calculate the NAV of the following fund, assuming 3,500 shares are outstanding. Calculate the percentage change in the NAV of the fund if stock C climbs to $33.41. Stock Shares owned 500 6,000 3,000 n.a. price $5.74 $65.10 $12.04 $4,368.40 Cash a. Will the NAV increase or decrease? Why? b. Calculated your return on your investment given the change in NAV 3. Suppose the Swiss Franc is currently traded at SFR 1.40/$. The British Pound is traded at GBP 1.39/$. Ignoring transaction costs: a. Determine the SFR/GBP exchange rate consistent with these direct quotations. b. Suppose the SFR/GBP cross rate in the market was at SFR 1.05/GBP. Is there any arbitrage opportunity? 4. Consider the following three stocks: Stock A is expected to provide a dividend of $10 a share forever Stock B is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 4% a year forever. Stock C is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 20% a year for 5 years (until year 6) and zero thereafter. a. If the market capitalization rate for each stock is 10%, which stock is the most valuable? b. What happens if the capitalization rate drops to 7%? Explain c. Assume EPS for stock A is 5, Stock B 7, and Stock C 20. Calculate the P/E ratio for each. Briefly explain what the different values mean to you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts