Question: Exercises 2B and 3B Problem 11B Mastery Problem 29 Sale No. 106 to Saga, Inc., $1,450 plus sales tax. REQUIRED 1. Record the transactions starting

Exercises 2B and 3B

Problem 11B

Mastery Problem

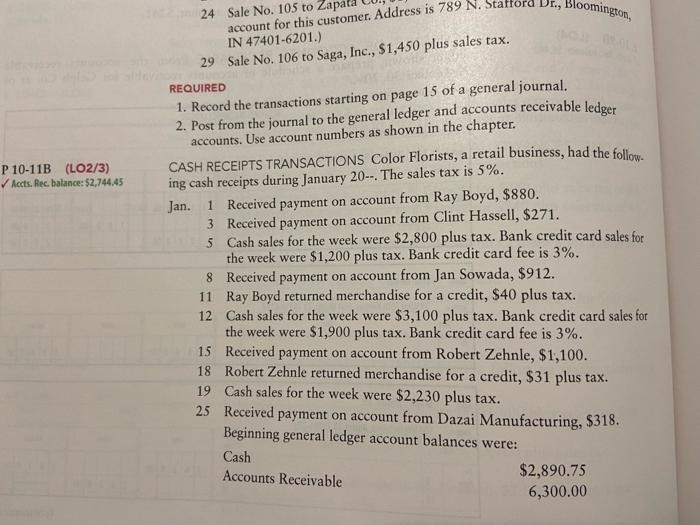

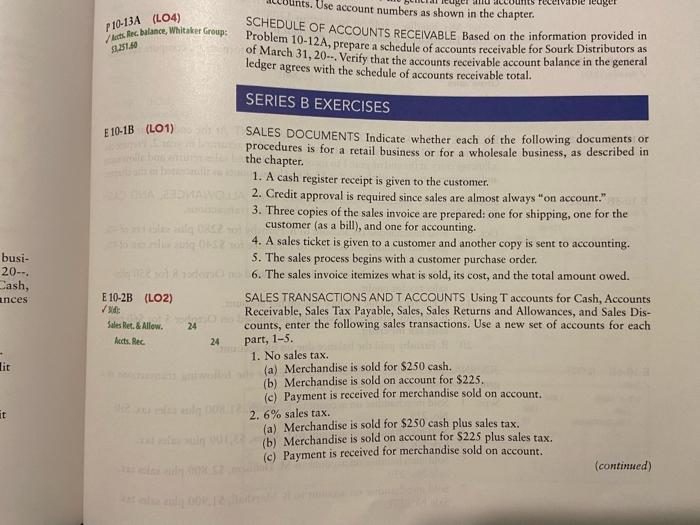

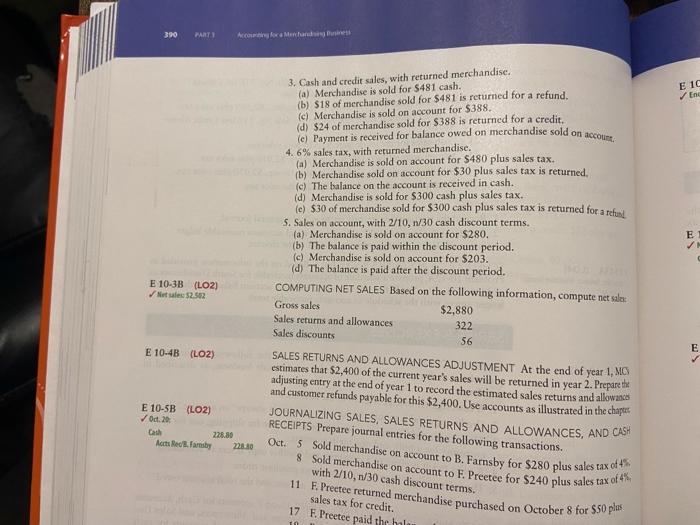

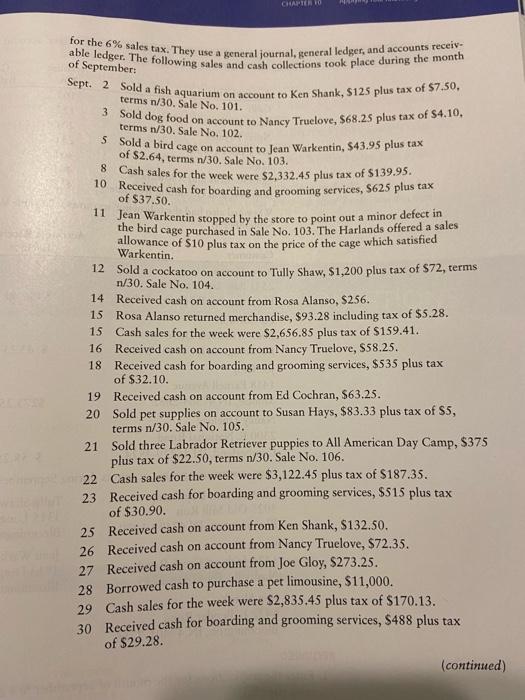

29 Sale No. 106 to Saga, Inc., $1,450 plus sales tax. REQUIRED 1. Record the transactions starting on page 15 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter. P 10-11B (LO2/3) CASH RECEIPTS TRANSACTIONS Color Florists, a retail business, had the follow. Accts. Rec balance: $2,744.45 ing cash receipts during January 20. The sales tax is 5%. Jan. 1 Received payment on account from Ray Boyd, $880. 3 Received payment on account from Clint Hassell, \$271. 5 Cash sales for the week were $2,800 plus tax. Bank credit card sales for the week were $1,200 plus tax. Bank credit card fee is 3%. 8 Received payment on account from Jan Sowada, $912. 11 Ray Boyd returned merchandise for a credit, $40 plus tax. 12 Cash sales for the week were $3,100 plus tax. Bank credit card sales for the week were $1,900 plus tax. Bank credit card fee is 3%. 15 Received payment on account from Robert Zehnle, $1,100. 18 Robert Zehnle returned merchandise for a credit, $31 plus tax. 19 Cash sales for the week were $2,230 plus tax. 25 Received payment on account from Dazai Manufacturing, $318. Beginning general ledger account balances were: CashAccountsReceivable$2,890.756,300.00 P10-13A (LO4) SCHEDULE OF ACCOUNTS RECEIVABLE Based on the information provided in /hathiec, balance, Whitaker Group: Problem 10-12A, prepare a schedule of accounts receivable for Sourk Distributors as of March 31,20. Verify that the accounts receivable account balance in the general ledger agrees with the schedule of accounts receivable total. SERIES B EXERCISES SALES DOCUMENTS Indicate whether each of the following documents or procedures is for a retail business or for a wholesale business, as described in the chapter. 1. A cash register receipt is given to the customer. 2. Credit approval is required since sales are almost always "on account." 3. Three copies of the sales invoice are prepared; one for shipping, one for the customer (as a bill), and one for accounting. 4. A sales ticket is given to a customer and another copy is sent to accounting. 5. The sales process begins with a customer purchase order. 6. The sales invoice itemizes what is sold, its cost, and the total amount owed. E 10-2B (LO2) SALES TRANSACTIONS AND T ACCOUNTS Using T accounts for Cash, Accounts 6n: Receivable, Sales Tax Payable, Sales, Sales Returns and Allowances, and Sales DisAnts. Pec 24 part, 1-5. 1. No sales tax. (a) Merchandise is sold for $250 cash. (b) Merchandise is sold on account for $225. (c) Payment is received for merchandise sold on account. 2. 6% sales tax. (a) Merchandise is sold for $250 cash plus sales tax. (b) Merchandise is sold on account for $225 plus sales tax. (c) Payment is received for merchandise sold on account. (continued) 3. Cash and credit sales, with returned merchandise. (a) Merchandise is sold for 5481 cash. (b) $18 of merchandise sold for $481 is peturned for a refund. (c) Merchandise is sold on account for $388. (d) $24 of merchandise sold for $388 is returned for a credit. (c) Payment is received for balance owed on merchandise sold on accourt. 4. 6% sales tax, with returned merchandise. (a) Merchandise is sold on account for $480 plus sales tax. (b) Merchandise sold on account for $30 plus sales tax is returned, (c) The balance on the account is received in cash. (d) Merchandise is sold for $300 cash plus sales tax. (c) $30 of merchandise sold for $300 cash plus sales tax is returned for a refusd 5. Sales on account, with 2/10,n/30 cash discount terms. (a) Merchandise is sold on account for $280. (b) The balance is paid within the discount period. (c) Merchandise is sold on account for $203. (d) The balance is paid after the discount period. COMPUTING NET SALES Based on the following information, compute net sala: SALES RETURNS AND ALLOWANCES ADJUSTMENT At the end of year 1 ,MC estimates that $2,400 of the current year's sales will be returned in year 2. Prepareth adjusting entry at the end of year 1 to record the estimated sales returns and allowano and customer refunds payable for this $2,400. Use accounts as illustrated in the charge JOURNALIZING SALES, SALES RETURNS AND ALLOWANCES, AND CASH RECEIPTS Prepare journal entries for the following transactions. Oct. 5 Sold merchandise on account to B. Farnsby for $280 plus sales tax oft\%: 8 Sold merchandise on account to F. Preetee for $240 plus sales tax of 4 ra with 2/10,n/30 cash discount terms. 11 Fi Prectee returned merchandise purchased on October 8 for $50 plas. sales tax for credit. 17 F. Preetce paid the Supply faxed a credit request rom form back to Wholesale Health Supply. Robotio Earth Foods faxed the completed form back to Wealth Supply, saw the credit application Sylvester, the sales manager at Wholesale Heal in business for two months. Thimk. ing she might lose the order if Good Earth Foods wasn't extended credit, Roobin authorized the shipment. She figured by the time the credit department rejected the application, Good Earth Foods would have received the order and the vice presidere would override the rejection to keep a new customer. Robin was sure that everything would turn out alright. 1. Do you think Robin's decision to ship the order was unethical? Why or why not? 2. What would you have done if you were in Robin's position? 3. Write a memo from the credit department manager to Robin Sylvester explaining the reasoning behind requiring a new credit customer to be in business for at least six months. 4. In small groups, discuss ways to prevent a situation like this from happening. MASTERY PROBLEM Geoff and Sandy Harland own and operate Wayward Kennel and Pet Supply. Their motto is, "If your pet is not becoming to you, he should be coming to us." The Harlands maintain a sales tax payable account throughout the month to account for the 6% sales tax. They use a general journal, general ledger, and accounts receivable ledger. The following sales and cash collections took place during the month of September: Sept. 2 Sold a fish aquarium on account to Ken Shank, \$125 plus tax of $7.50, terms n/30. Sale No. 101. 3 Sold dog food on account to Nancy Truelove, $68.25 plus tax of $4.10, terms n/30. Sale No, 102 . 5 Sold a bird cage on account to Jean Warkentin, \$43.95 plus tax of $2.64, terms n/30. Sale No. 103 . 8 Cash sales for the week were $2,332.45 plus tax of $139.95. 10 Received cash for boarding and grooming services, $625 plus tax of $37.50. 11 Jean Warkentin stopped by the store to point out a minor defect in the bird cage purchased in Sale No. 103. The Harlands offered a sales allowance of $10 plus tax on the price of the cage which satisfied Warkentin. 12 Sold a cockatoo on account to Tully Shaw, $1,200 plus tax of $72, terms n/30. Sale No. 104. 14 Received cash on account from Rosa Alanso, \$256. 15 Rosa Alanso returned merchandise, $93.28 including tax of $5.28. 15 Cash sales for the week were $2,656.85 plus tax of $159.41. 16 Received cash on account from Nancy Truelove, $58.25. 18 Received cash for boarding and grooming services, $535 plus tax of $32.10. 19 Received cash on account from Ed Cochran, \$63.25. 20 Sold pet supplies on account to Susan Hays, $83.33 plus tax of $5, terms n/30. Sale No. 105 . 21 Sold three Labrador Retriever puppies to All American Day Camp, $375 plus tax of $22.50, terms n/30. Sale No. 106 . 22 Cash sales for the week were $3,122.45 plus tax of $187.35. 23 Received cash for boarding and grooming services, $515 plus tax of $30.90. 25 Received cash on account from Ken Shank, \$132.50. 26 Received cash on account from Nancy Truelove, $72.35. 27 Received cash on account from Joe Gloy, \$273.25. 28 Borrowed cash to purchase a pet limousine, $11,000. 29 Cash sales for the week were $2,835.45 plus tax of $170.13. 30 Received cash for boarding and grooming services, $488 plus tax of $29.28. (continued)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts