Question: Exercises: 5.1, 5.3 , 5.5 , 5.7 , 5.9 , 5.11 , 5.13 PROBLEMS 5-1 5-2 5 3 Yesterday Travis sold 1,000 shares of stock

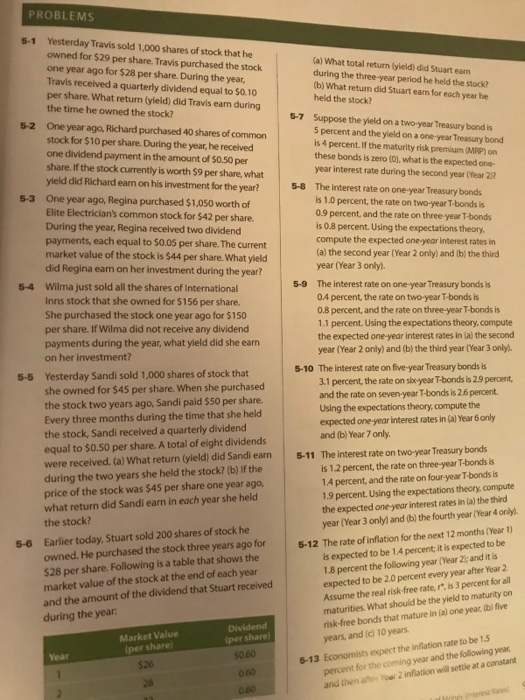

PROBLEMS 5-1 5-2 5 3 Yesterday Travis sold 1,000 shares of stock that he owned for $29 per share. Travis purchased the stock one year ago for $28 per share. During the year, Travis received a quarterly dividend equal to $0.10 per share. What return (yield) did Travis earn during the time he owned the stock? One year ago, Richard purchased 40 shares of common stock for $10 per share. During the year, he received one dividend payment in the amount of $0.50 per share. If the stock currently is worth $9 per share, what yield did Richard earn on his investment for the year? One year ago, Regina purchased $1,050 worth of Elite Electrician's common stock for $42 per share. During the year, Regina received two dividend payments, each equal to 50.05 per share. The current market value of the stock is $44 per share. What yield did Regina eam on her investment during the year? Wilma just sold all the shares of International Inns stock that she owned for $156 per share. She purchased the stock one year ago for $150 per share. If Wilma did not receive any dividend payments during the year, what yield did she eam on her investment? Yesterday Sandi sold 1,000 shares of stock that she owned for $45 per share. When she purchased the stock two years ago, Sandi paid $50 per share. (a) What total return yield) did Stuart earn during the three-year period he held the stock? (b) What retum did Stuart earn for each year the held the stock? Suppose the yield on a two-year Treasury bond is 5 percent and the yield on a one year Treasury bond is 4 percent. If the maturity risk premium (MAP) on these bonds is zero (Ol. what is the expected one year interest rate during the second year Year 22 5-8 The interest rate on one year Treasury bonds is 1.0 percent, the rate on two-year T-bonds is 0.9 percent, and the rate on three-year T-bonds is 0.8 percent. Using the expectations theory, compute the expected one year interest rates in (a) the second year (Year 2 only) and (b) the third year (Year 3 only). 5-9 The interest rate on one-year Treasury bonds is 0.4 percent, the rate on two-year T-bonds is 0.8 percent, and the rate on three-year T-bonds is 1.1 percent. Using the expectations theory, compute the expected one-year interest rates in (a) the second year (Year 2 only) and (b) the third year (Year 3 only). 5-10 The interest rate on five-year Treasury bonds is 3.1 percent, the rate on six year T-bonds is 29 percent, and the rate on seven year T-bonds is 26 percent. Using the expectations theory, compute the expected one year interest rates in (a) Year 6 only and (b) Year 7 only. 5-5 Every three months during the time that she held the stock, Sandi received a quarterly dividend equal to $0.50 per share. A total of eight dividends were received. (a) What return (yield) did Sandi earn during the two years she held the stock? (b) If the price of the stock was $45 per share one year ago what return did Sandi earn in each year she held the stock? Earlier today, Stuart sold 200 shares of stock he owned. He purchased the stock three years ago for $28 per share. Following is a table that shows the market value of the stock at the end of each year and the amount of the dividend that Stuart received during the year Market Value Dividend (per share per share 5-11 The Interest rate on two year Treasury bonds is 1.2 percent, the rate on three-year T-bonds is 1.4 percent and the rate on four-year T-bonds is 1.9 percent. Using the expectations theory, compute the expected one year interest rates in (a) the third year (Year 3 only) and (b) the fourth year (Year 4 only. 5-12 The rate of inflation for the next 12 months (Year 1) is expected to be 14 percent, it is expected to be 1.8 percent the following year (Year 2: and it is expected to be 20 percent every year after year 2. Assume the real risk free rater, is 3 percent for all maturities. What should be the yield to maturity on risk-free bonds that mature in al one year, (b) five years, and (c) 10 years 5-13 Economists expect the inflation rate to be 15 percent for the coming year and the following year and then after 2 inflation will settle at a constant $26 50.60 0.60 est w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts