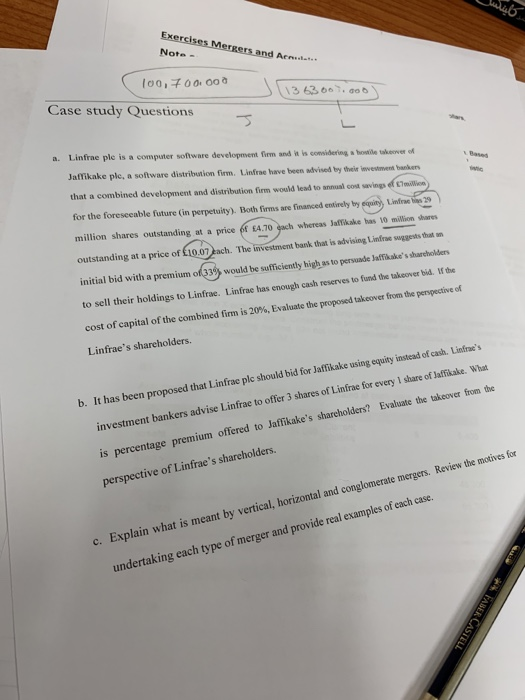

Question: Exercises Mergers and Note - 100,700.000 [ 13 6300.000) Case study Questions a. Linfrae ple is a computer software development form and is considering those

Exercises Mergers and Note - 100,700.000 [ 13 6300.000) Case study Questions a. Linfrae ple is a computer software development form and is considering those weer of Jallikake ple, a software distribution form. Linfrae have been advised by the weinventbunkers that a combined development and distribution firm would lead to al cost savings will for the foreseeable future in perpetuity). Both forms are faced entirely bysty L n 19 million shares outstanding at a price of $4.70 each whereas Jakake bas 10 million shares w a t outstanding at a price of 10.07 kach. The investment bank that is advising Line initial bid with a premium of 33% would be sufficiently high as to persuade Jaffake's shacholders to sell their holdings to Linfre. Linfrae has enough cash reserves to fund the takeover bid. The cost of capital of the combined firm is 20%, Evaluate the proposed takeover from the perspective of Linfrae's shareholders. b. It has been proposed that Linfrae ple should bid for Jaffikake using equity instead of cash. Line's investment bankers advise Linfrae to offer 3 shares of Linfrae for every 1 share of Jaffake. What is percentage premium offered to Jaffikake's shareholders? Evaluate the takeover from the perspective of Linfrae's shareholders. c. Explain what is meant by vertical, horizontal and conglomerate mergers. Review the motives for undertaking each type of merger and provide real examples of each case. ** FABER CASTELL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts