Question: Exercises on Adjusting Journal Entries Please answer all P5-6 REQUIRED: Prepare adjusting journal entries from the books of Silent Company as of December 31, 2015.

Exercises on Adjusting Journal Entries

Please answer all

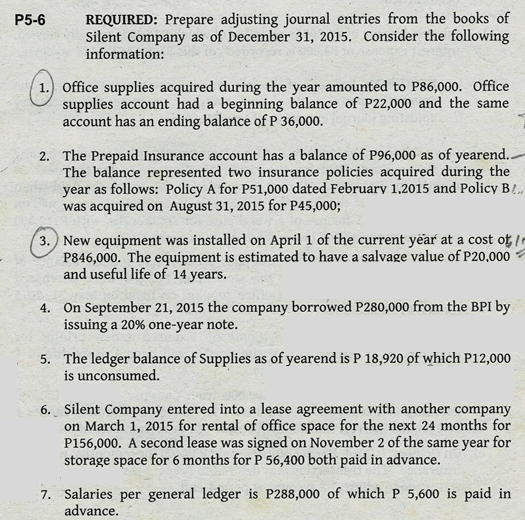

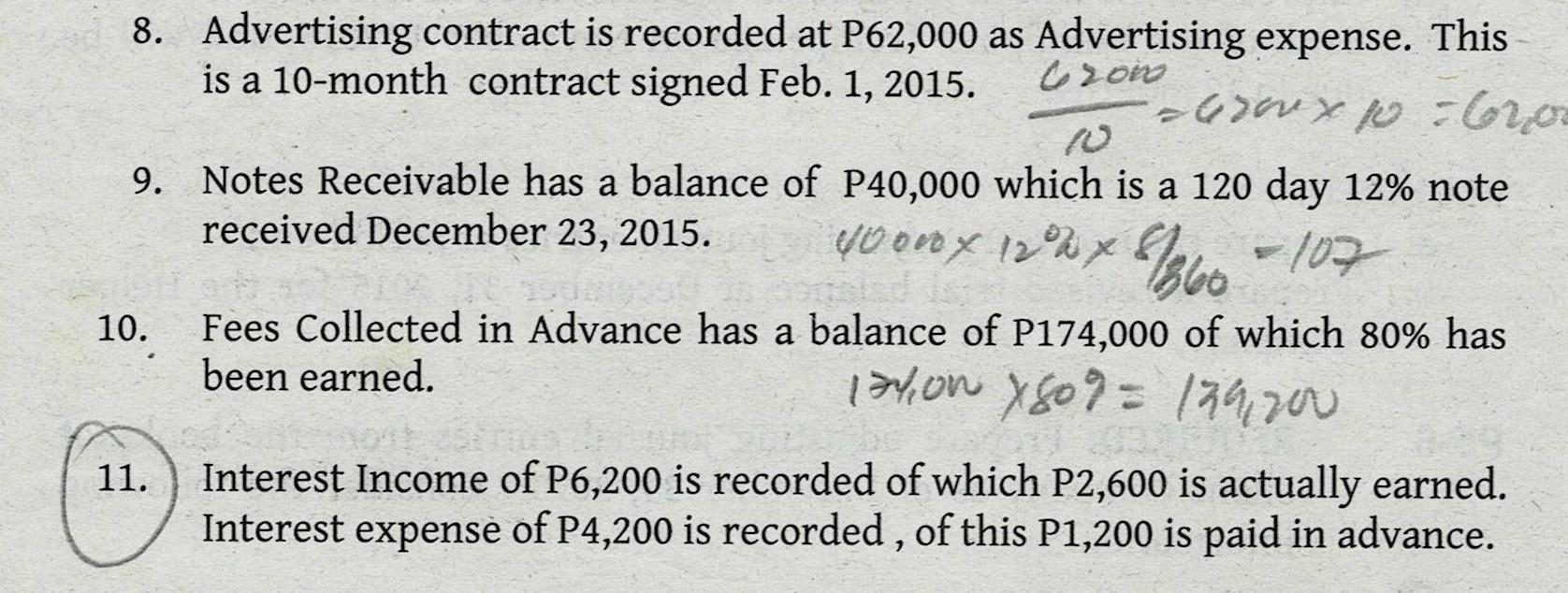

P5-6 REQUIRED: Prepare adjusting journal entries from the books of Silent Company as of December 31, 2015. Consider the following information: 1. Office supplies acquired during the year amounted to P86,000. Office supplies account had a beginning balance of P22,000 and the same account has an ending balance of P 36,000. 2. The Prepaid Insurance account has a balance of P96,000 as of yearend. The balance represented two insurance policies acquired during the year as follows: Policy A for P51,000 dated February 1,2015 and Policy B! was acquired on August 31, 2015 for P45,000; 3. New equipment was installed on April 1 of the current year at a cost ot/ P846,000. The equipment is estimated to have a salvage value of P20,000 and useful life of 14 years. 4. On September 21, 2015 the company borrowed P280,000 from the BPI by issuing a 20% one-year note. 5. The ledger balance of Supplies as of yearend is P 18,920 of which P12,000 is unconsumed. 6. Silent Company entered into a lease agreement with another company on March 1, 2015 for rental of office space for the next 24 months for P156,000. A second lease was signed on November 2 of the same year for storage space for 6 months for P 56,400 both paid in advance. 7. Salaries per general ledger is P288,000 of which P 5,600 is paid in advance. 8. Advertising contract is recorded at P62,000 as Advertising expense. This is a 10-month contract signed Feb. 1, 2015. e sono 670x po =6200 9. Notes Receivable has a balance of P40,000 which is a 120 day 12% note received December 23, 2015. yoond x 12W 1860-107 10. Fees Collected in Advance has a balance of P174,000 of which 80% has been earned. 18yon 80%= 129,000 11. Interest Income of P6,200 is recorded of which P2,600 is actually earned. Interest expense of P4,200 is recorded , of this P1,200 is paid in advance. P5-6 REQUIRED: Prepare adjusting journal entries from the books of Silent Company as of December 31, 2015. Consider the following information: 1. Office supplies acquired during the year amounted to P86,000. Office supplies account had a beginning balance of P22,000 and the same account has an ending balance of P 36,000. 2. The Prepaid Insurance account has a balance of P96,000 as of yearend. The balance represented two insurance policies acquired during the year as follows: Policy A for P51,000 dated February 1,2015 and Policy B! was acquired on August 31, 2015 for P45,000; 3. New equipment was installed on April 1 of the current year at a cost ot/ P846,000. The equipment is estimated to have a salvage value of P20,000 and useful life of 14 years. 4. On September 21, 2015 the company borrowed P280,000 from the BPI by issuing a 20% one-year note. 5. The ledger balance of Supplies as of yearend is P 18,920 of which P12,000 is unconsumed. 6. Silent Company entered into a lease agreement with another company on March 1, 2015 for rental of office space for the next 24 months for P156,000. A second lease was signed on November 2 of the same year for storage space for 6 months for P 56,400 both paid in advance. 7. Salaries per general ledger is P288,000 of which P 5,600 is paid in advance. 8. Advertising contract is recorded at P62,000 as Advertising expense. This is a 10-month contract signed Feb. 1, 2015. e sono 670x po =6200 9. Notes Receivable has a balance of P40,000 which is a 120 day 12% note received December 23, 2015. yoond x 12W 1860-107 10. Fees Collected in Advance has a balance of P174,000 of which 80% has been earned. 18yon 80%= 129,000 11. Interest Income of P6,200 is recorded of which P2,600 is actually earned. Interest expense of P4,200 is recorded , of this P1,200 is paid in advance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts